Poultry Market Outlook - March

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

Commodity markets have seen little change in recent weeks. Operators are eagerly awaiting 2 April to learn the true extent of the tariff measures imposed by the United States. The US market is already suffering from the potential retaliatory measures being implemented by the targeted countries. Meanwhile, the Chinese market is showing signs of strain in this looming trade war..

Corn

- On the US market, corn prices fell by $14/t in March. The tariffs proposed by Donald Trump are putting pressure on American corn. Retaliatory measures being considered by targeted countries could further undermine its export prospects.

- On the Brazilian market, maize prices increased both in local currency and in US dollars. This rise is due to adverse weather conditions in South America, with a hot, dry spell in Brazil and excessive rainfall in Argentina.

- European corn rose by $9/t in March, but it is primarily due to currency movements. In euro terms, however, prices remained stable at $222/t. The European market is showing little movement as it awaits the implementation of tariffs scheduled for 2 April.

- On the Chinese market, maize prices rose by $8/t in March, fueled by rising trade tensions between Washington and Beijing.

Soya and Soybean meal

- On the Brazilian market, soybean meal prices continued to decline as the harvest progressed. In March, the average price was $388/t, a decrease of $3/t from February.

- The US market is also trending downward ($301/t in March), following the Brazilian market and under the threat of a trade war. This is raising concerns among American operators about a potential loss of export outlets.

- As with corn, soybean meal prices increased on the European market due to a rebound in the euro/dollar exchange rate. However, prices fell in local currency, reflecting the global downward trend

- On the Chinese market, soybean meal prices moved in the opposite direction to other markets (+$18/t). The retaliatory measures announced by Beijing are creating uncertainty for Chinese importers, who may have to manage without US supplies.

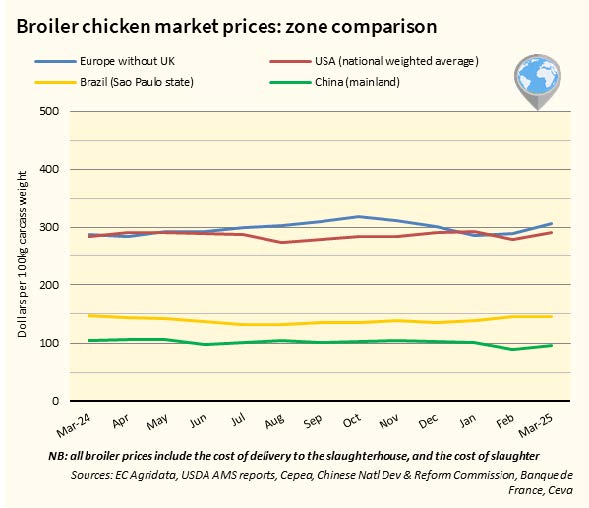

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

In March, global chicken prices increased amid the ongoing trade war initiated. While the poultry sector has shown resilience, with global growth projections exceeding 2.5% in 2025, the imposition of tariffs by the U.S.—and potential retaliatory measures—could have significant short- and medium-term effects. These may include a reorientation of trade flows away from the U.S. in favor of Brazil and Europe, along with an acceleration in the trend toward production relocation aimed at enhancing self-sufficiency. In terms of pricing, stability is expected over the coming months, supported by declining soybean and corn prices, which continue to ensure strong profitability.

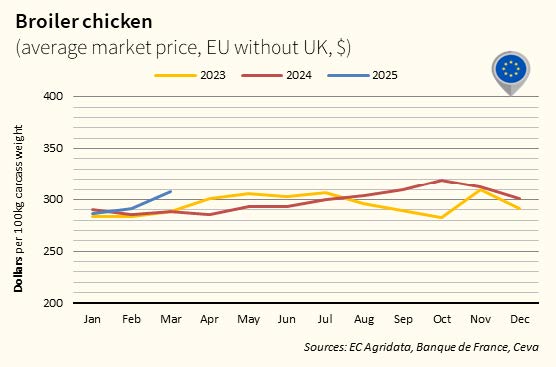

BROILER CHICKEN PRICE OVERVIEW – EUROPE

EU chicken prices rose, due to decreasing supplies and growing demand in the context of low purchasing power and the renewed popularity of poultry. Shortages of hatching eggs and Gallus chicks persist, particularly in Poland, the Netherlands and France. The trade war between the United States and Europe seems to be favoring European exports to Asia, particularly China. Imports rose sharply in March 2025 (+18%), notably from Brazil (+43%), Ukraine (+14%) and China (+60%).

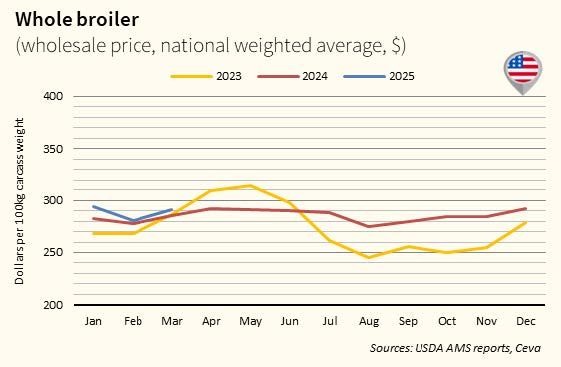

BROILER CHICKEN PRICE OVERVIEW – USA

US chicken prices rose by 4% due to strong domestic demand, despite underperformance in exports caused by the spread of HPAI. Addi-tionally, Trump’s announcements regarding the imposition of tariffs could place the poultry sector at risk of retaliatory measures from other countries, potentially leading to a decline in exports, particularly to the Asian market. During the first two months of 2025, exports dropped by 16%, mainly to China (-70%) and Vietnam (-33%).

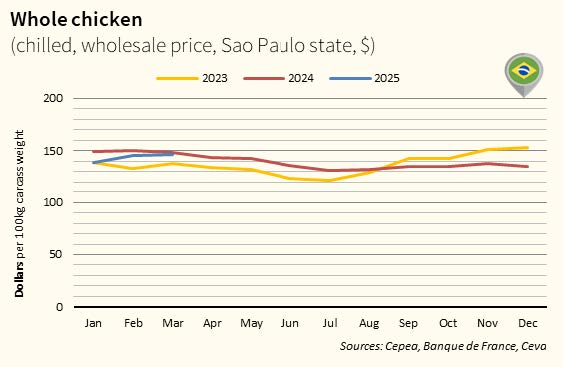

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

Brazilian chicken prices increased by 1%, driven by strong export performance (+ 6%), despite a decline in domestic demand in certain regions. In 2025, Brazil is expected to set new export records, benefiting from strong international demand, competitive supply, and its HPAI free status. Moreover, in the event of a trade war, Brazil is poised to benefit, with potential gains in markets such as China and Asia in general. In March, exports rose by 13%, fueled by increased sales to China (+19%) and the Philippines (+44%).

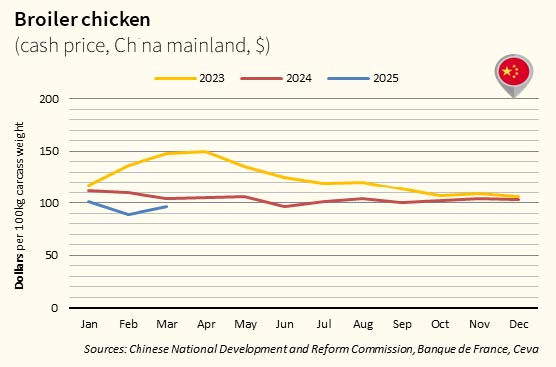

BROILER CHICKEN PRICE OVERVIEW – CHINA

Chicken prices in China rose by 8%, following a period of overproduction coupled with a decline in demand. The gradual adjustment in supply from slaughterhouses, along with reduced imports from the U.S. in March, contributed to the price increase. The trade war is expected to impact the Chinese poultry sector, with a reduction in U.S. imports and a potential rise in feed prices, depending on U.S. soybean availability.

POULTRY

POULTRY