Poultry Market Outlook - February

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

Since the beginning of the year, confusion has dominated the grain markets. Donald Trump’s repeated shifts in US trade policy have disrupted market and driven volatility. In this particularly fragile context, fundamentals have taken a back seat, with prices fluctuating based on various announcements.

Corn

- On the US market, corn prices rose in February (+$4/t), reaching $190/t, though at a slower pace than before. The early-month increase, partly driven by concerns over the Argentine harvest, was later offset by improving conditions in South America and strong selling activity from U.S. producers.

- As mentioned above, weather conditions deteriorated in early February in South America, with hot and dry conditions in Argentina and excessive rainfall in Brazil. As a result, corn prices surged on the Brazilian market, reaching $233.4/t compared to $205.1/t in January.

- European corn followed its U.S. counterpart, gaining $2.6/t in February to reach $231.5/t.

- The Chinese market has been shaken by new tariffs imposed by Donald Trump. In this tense trade environment, corn prices rebounded (+$3/t in a month) to $315/t. Similar price levels in China were last seen in June 2020.

Soya and Soybean meal

- On the Brazilian market, soybean meal prices fell by 2% in local currency. Harvests are progressing well despite early-season delays caused by heavy rainfall.

- In the United States, prices also resumed their downward trend, losing $9/t in a month to reach $304.8/t in February. Expected export volumes from Brazil are already weighing on the U.S. market, which risks losing competitiveness in the coming months.

- The European market is following the trend, with soybean meal prices dropping by $10/t in a month to $358/t, their lowest level since July 2020.

- In contrast, prices on the Chinese market are moving in the opposite direction. Rising by 10% in a month, soybean meal is affected by trade tensions with the United States. In response to increased tariffs on Chinese goods, Beijing has announced new taxes on a range of American products, including soybeans.

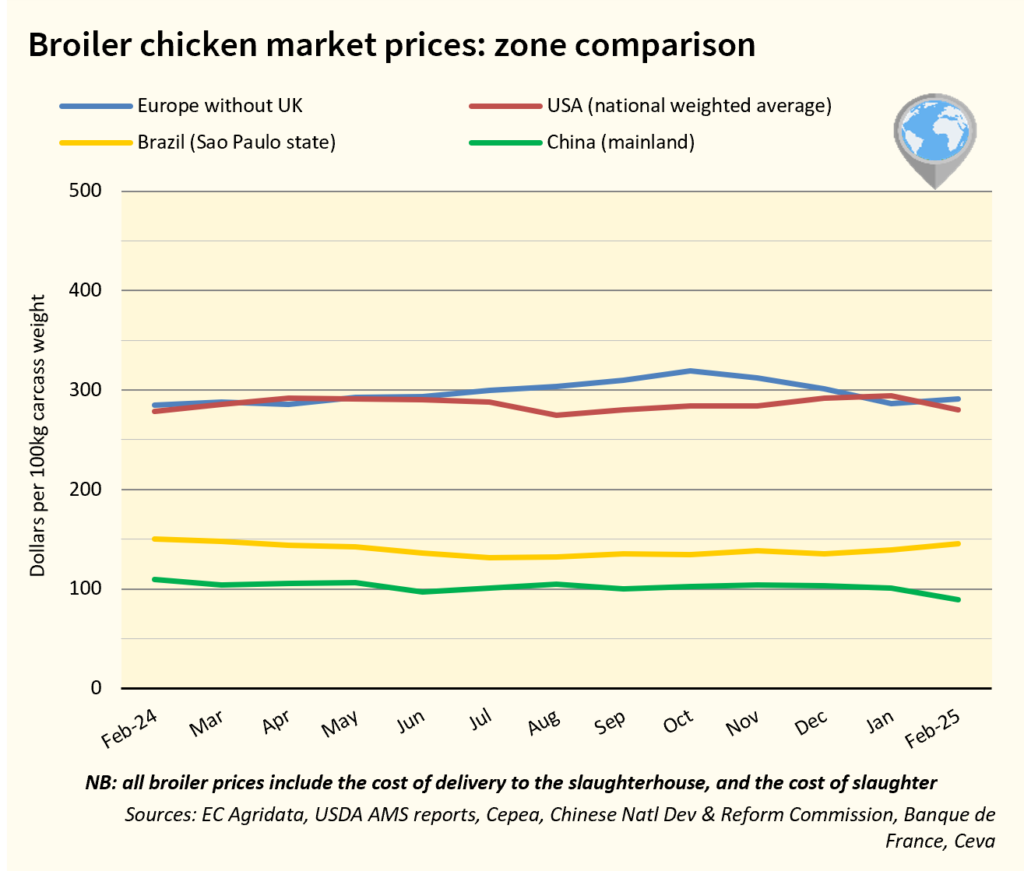

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

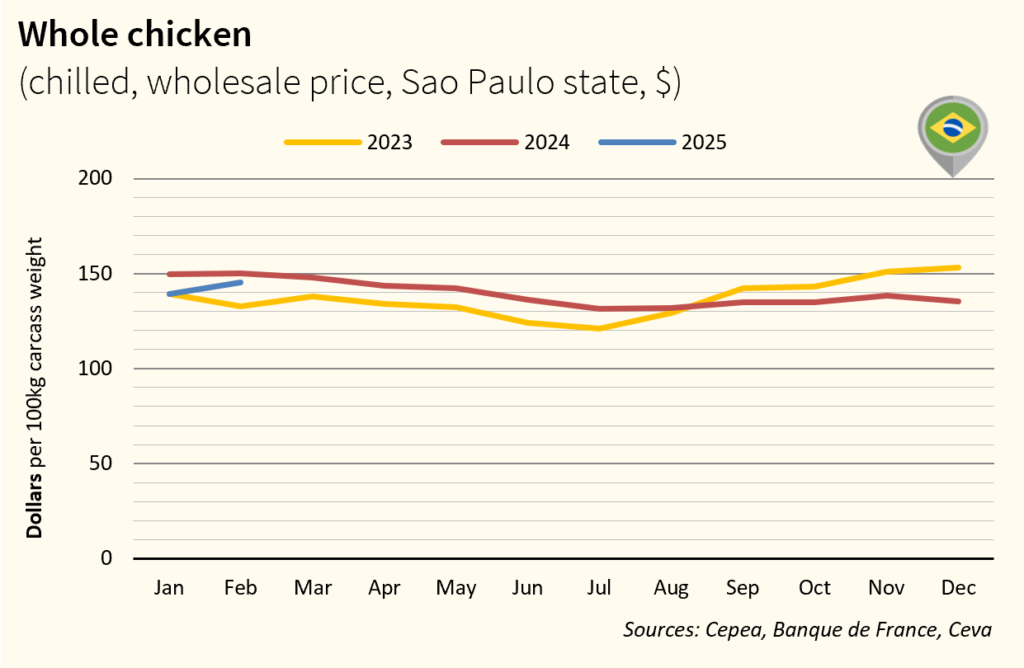

In February, chicken prices saw an upward trend in Europe, but declined in major production regions, with the exception of Brazil, where prices remained stable. However, the devaluation of the Brazilian real has negatively impacted the competitiveness of Brazilian chicken, which experienced a 4.5% price increase in dollar terms. The outlook for production growth and trade remains positive, but the trade policy under Trump could affect trade flows, as could concerns related to the USA’s HPAI situation, which is a growing global concern.

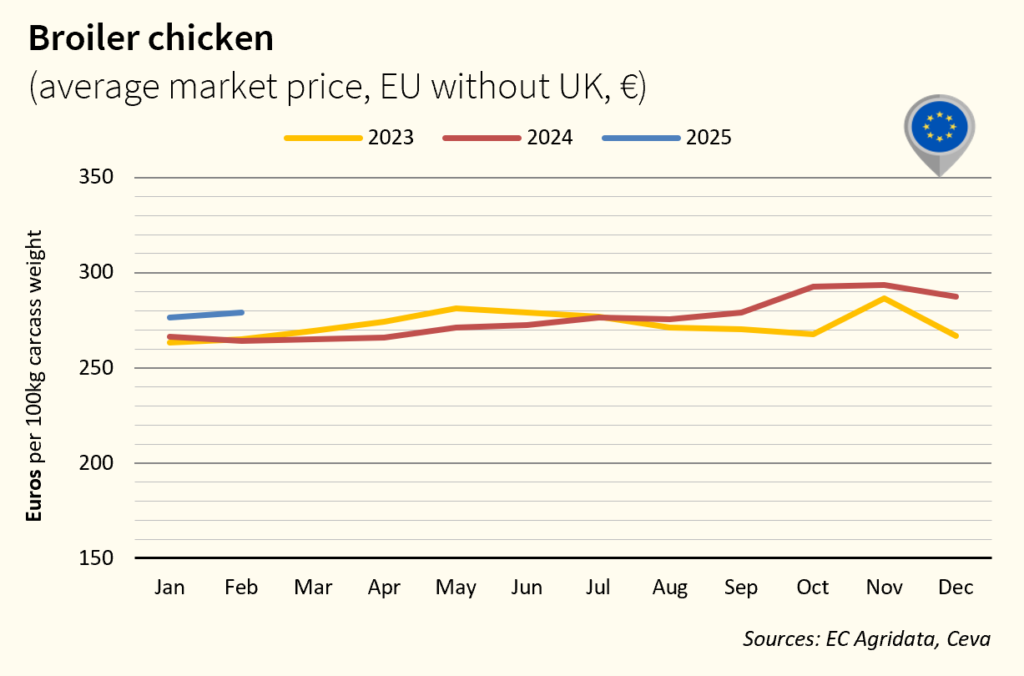

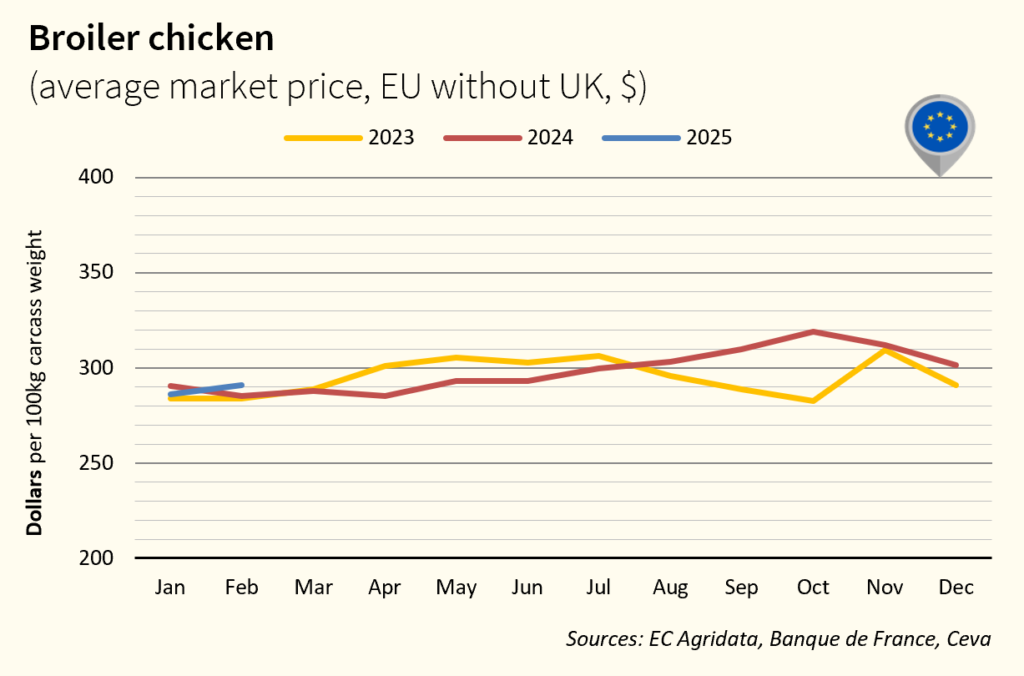

BROILER CHICKEN PRICE OVERVIEW – EUROPE

After a decline in January, chicken prices are on the rise again, driven by a persistent supply shortage and strong demand. Following a 6% increase in 2024, production growth is expected to slow to less than 3% in 2025, primarily due to a chronic shortage of chicks and hatching eggs in the EU market, which is hindering growth prospects, at least for the first half of 2025. While production is expected to increase in France, Germany, and Poland, Netherlands and Belgium are likely to experience declines in 2025.

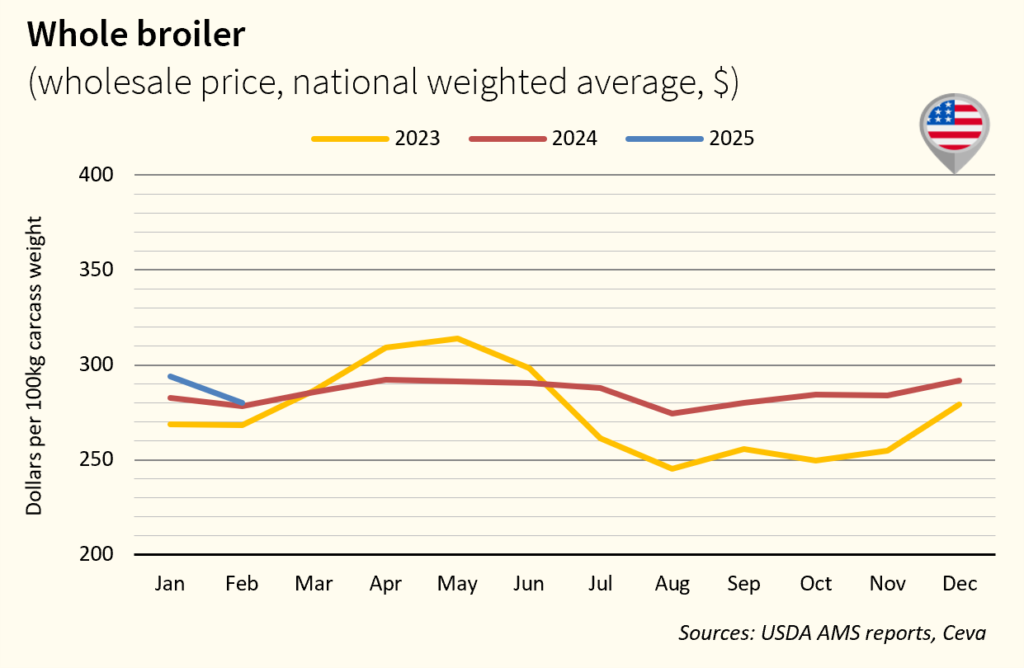

BROILER CHICKEN PRICE OVERVIEW – USA

In February, U.S. chicken prices declined by nearly 5%, driven by weaker domestic demand and sluggish market activity. Additionally, falling export demand—amid concerns over Highly Pathogenic Avian Influenza (HPAI) and ongoing trade tensions—has further pressured the local market, which is considered oversupplied. U.S. poultry exports continued to decline in January 2025, down 23%, largely due to a sharp 71% drop in shipments to China. However, the depreciation of the U.S. dollar could enhance the country’s competitiveness and potentially offset the impact of tariffs imposed by China on U.S. poultry.

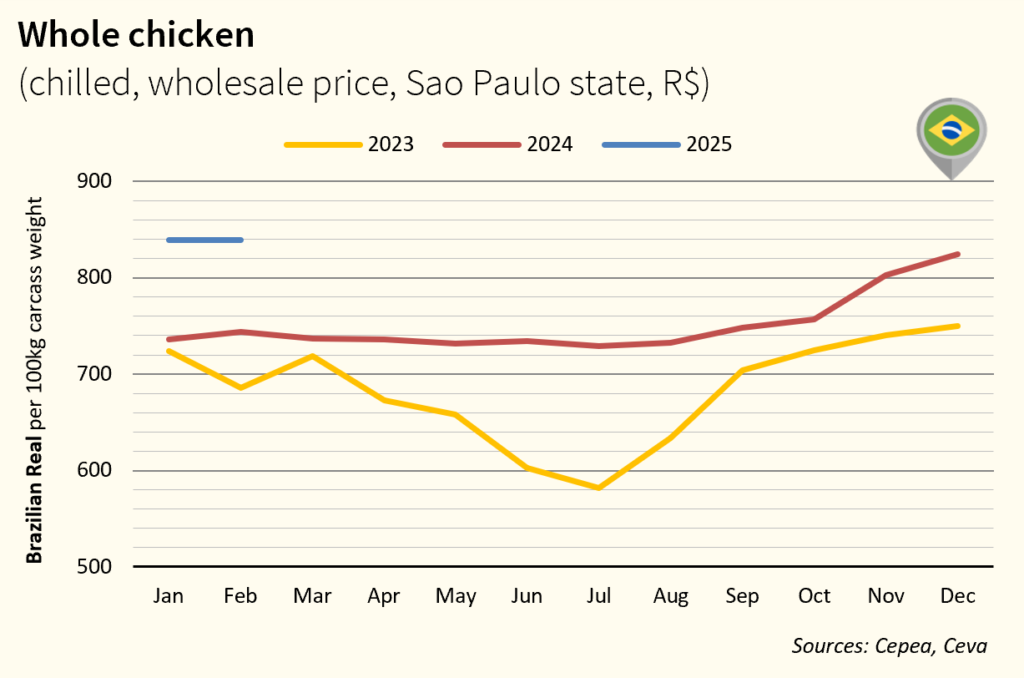

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

In Brazil, chicken prices remained relatively stable in February. Production continued to grow, but despite strong demand at the beginning of the month, a decline in certain regions towards the end of February led to lower prices, resulting in a stable monthly average. For the first time in seven years, the price gap between live and processed chicken reached a record 54% in February, allowing slaughterhouses to generate higher margins.

Brazil’s poultry exports surged by 19% year-on-year, setting a new record with 437,000 tons shipped. This growth was driven primarily by strong demand from Mexico (+260%) and China (+18%).

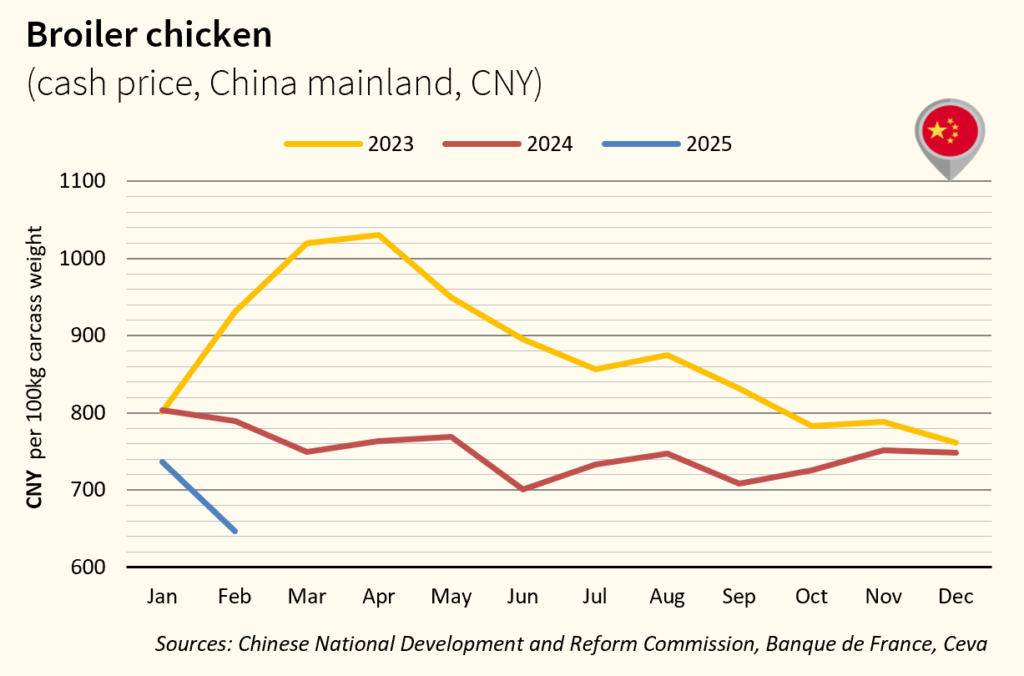

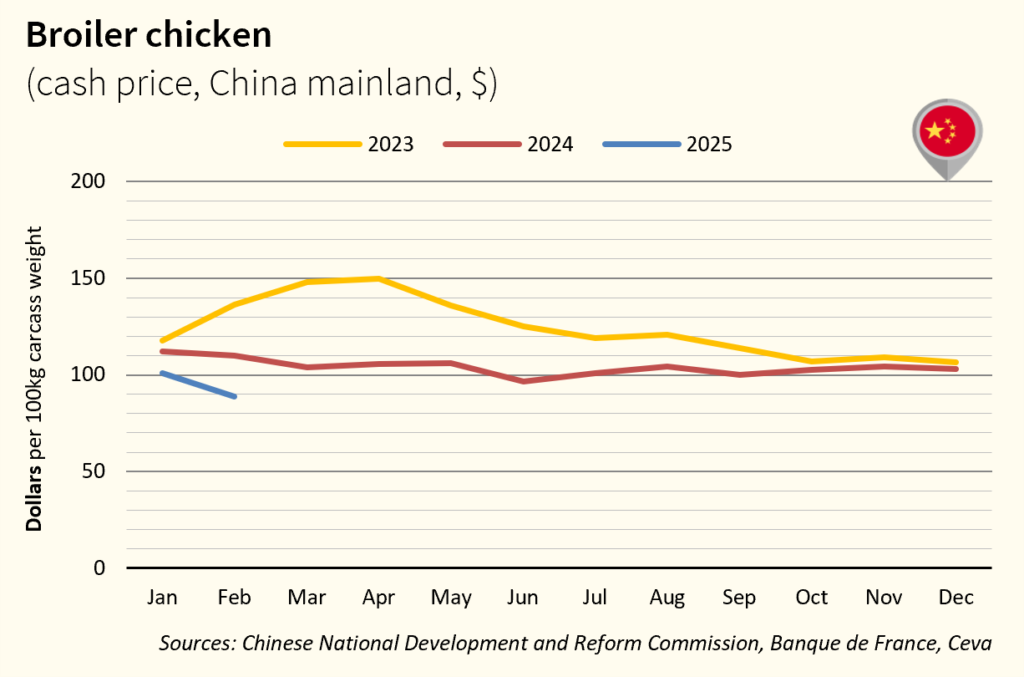

BROILER CHICKEN PRICE OVERVIEW – CHINA

In February, chicken prices in China dropped by 12%, reaching their lowest level since the ASF outbreak. This sharp decline was driven by an oversupply and a significant drop in demand due to the economic slowdown. However, this trend appears to be temporary, as prices rebounded by 9% in the first week of March amid recovering demand. With supply chain disruptions affecting breeder imports from the U.S. due to the HPAI outbreak, China has, for the first time, turned to France, placing two orders for breeder stock. Meanwhile, China’s poultry imports surged by 42% in February, supported by a 45% increase in shipments from Brazil.

POULTRY

POULTRY