Poultry Market Outlook - November

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

In November, commodity prices rose on the US market in response to the easing of tensions between Beijing and Washington. This rebound in the US market was passed through to Europe, where prices also increased. It now remains to be seen to what extent this improvement will translate into concrete purchasing actions by China for US products.

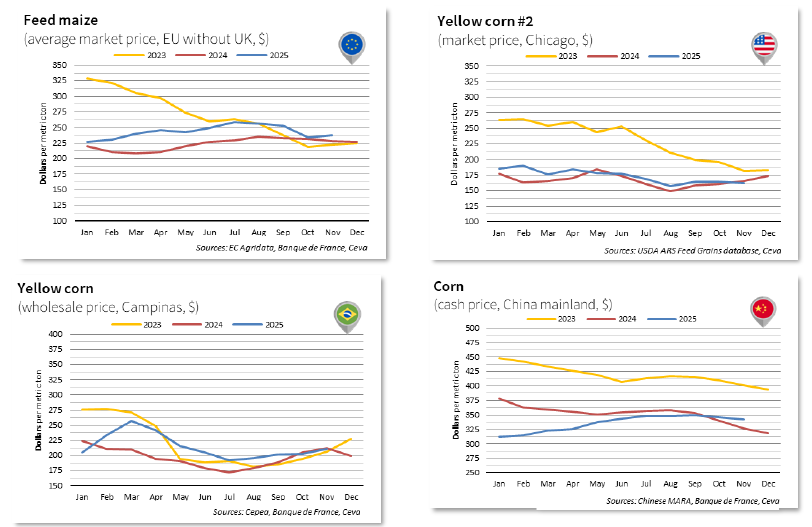

Corn

- US corn prices fell from $164.0/t to $ 161.8 /t. The improvement in relations between China and the United States prompted strong reactions among financial operators, lending support to prices at the beginning of the month. However, this support remains limited by heavy fundamentals, with production expected to reach 425.5 Mt (+14.8% vs. the 5-year average).

- Prices remain firm on the European market, in a context of declining supply (56.8 Mt, -9.2% vs. the 5-year average) and supported by US prices.

- In Brazil, prospects for the 2026 harvests are excellent, with growing conditions currently very favourable. However, prices remained high, supported by the rebound in U.S. prices at the beginning of the month.

- Corn prices edged down (-1.0% vs. October) on the Chinese market, following the trend set by US prices.

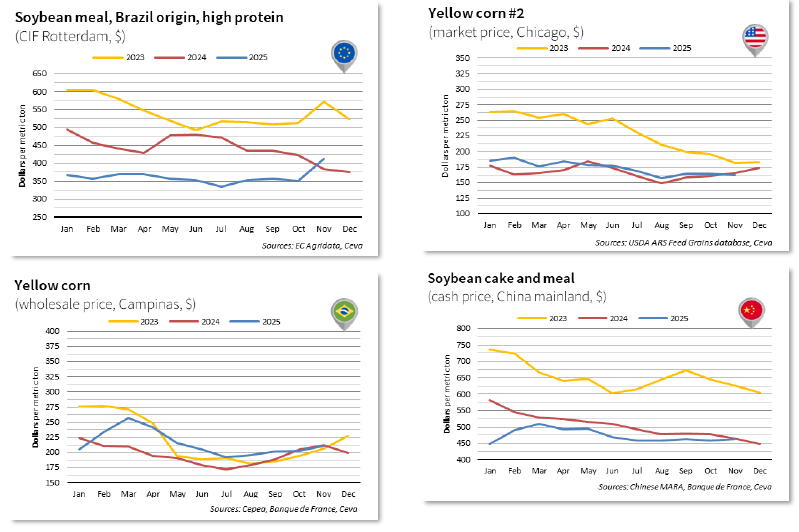

Soymeal

- US soybean meal prices surged in November, rising by $28.2/t over the month. This increase came in response to the apparent easing of relations between China and the U.S., illustrated by China’s pledge to import 12 Mt of US soybeans by the end of the year.

- The price rise recorded in the USA carried through to the European market, with a surge of +17.4%. However, prices remain very low compared with the past three years (–6.9% vs. the 2024 annual average).

- In Brazil, prices have decreased in November (-5.6% vs.nOctober). Nevertheless, they remain highly competitive compared with US prices, raising questions about the practical implementation of China’s pledge to shift towards US soybeans.

- In China, prices edged up, increasing from $458.9/t in October to $462.6/t in November. According to local agencies, China is reported to have substantial soybean stocks, having imported large volumes since the beginning of the marketing year.

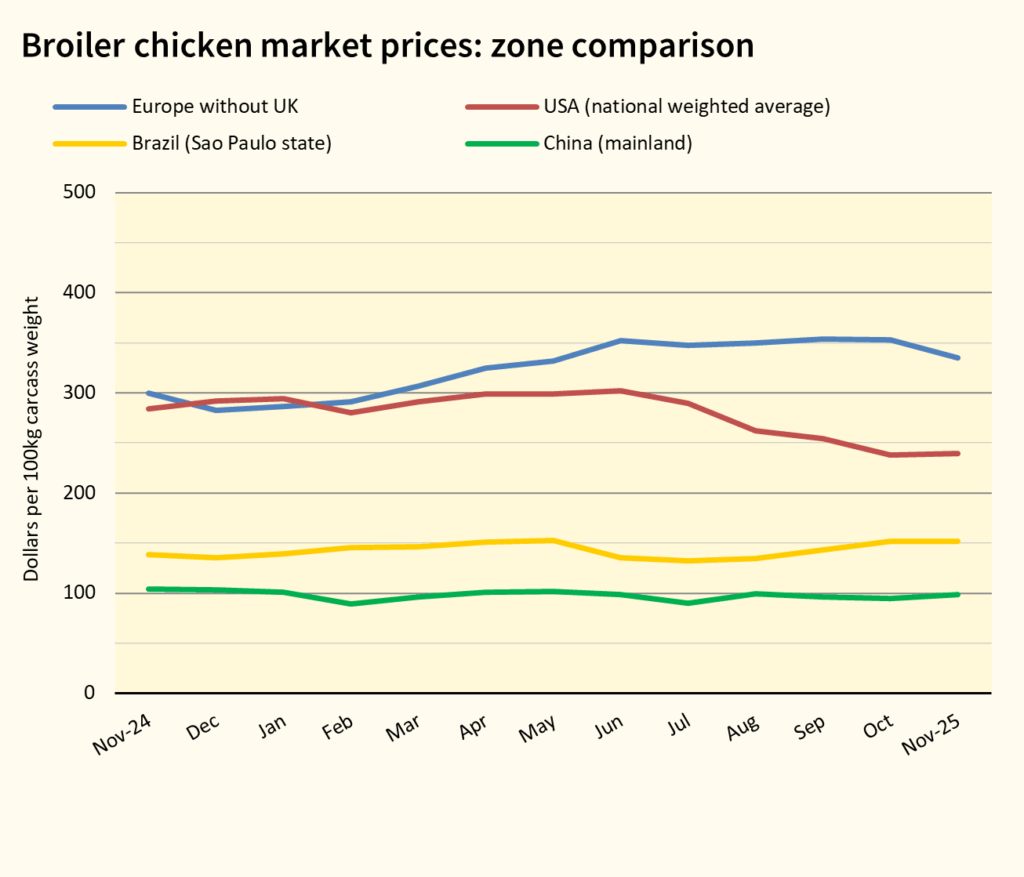

BROILER CHICKEN PRICE OVERVIEW – GLOBAL

In November, the broiler market situation improved, with a stabilization and even a slight easing of prices, thanks to the recovery of production, especially in Europe, and of Brazilian exports. The 2026 outlook for the sector is optimistic, with strong demand benefiting from reduced beef supply: high consumption and stable prices are expected. However, HPAI remains a key risk that may lead to reduced supply and restrictions on global trade.

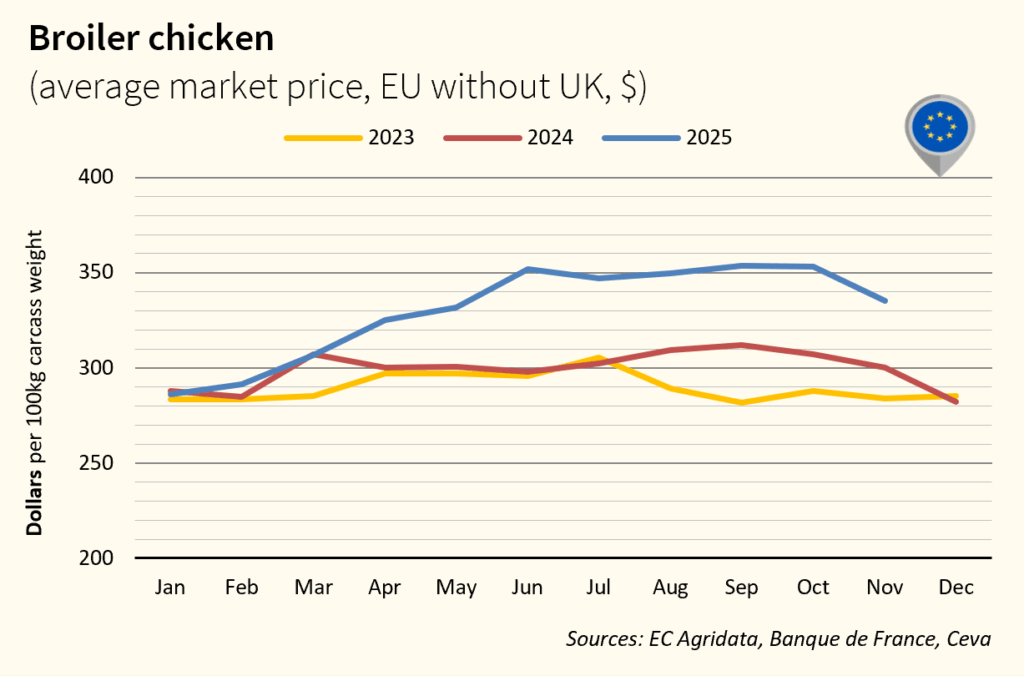

BROILER CHICKEN PRICE OVERVIEW – EUROPE

The resumption of full production in Poland and of Brazilian imports led to a 5% decline in broiler prices. Demand remains strong, while feed prices have stabilized at a low level. However, chick and hatching egg prices remain rather high due to persistent shortages, limiting a more dynamic expansion of production. Since October, HPAI outbreaks have surged across Europe (+/-400 cases). Broiler farms remain the least affected, with less than 40 outbreaks, mainly in the Netherlands and France. Despite the resumption of Brazilian imports since October, volumes remain 30% below last year’s level. Total EU imports declined by 16% in November.

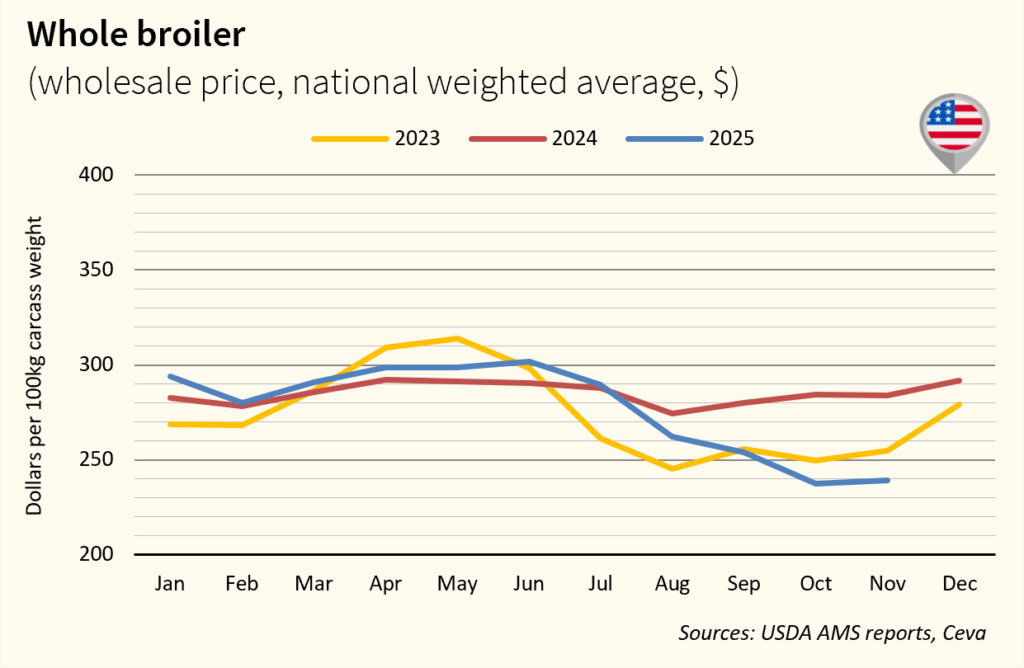

BROILER CHICKEN PRICE OVERVIEW – USA

US chicken prices remained relatively stable, supported by a 3.6% increase in production in Q3 and a projected 2.3% rise in Q4. Seasonal demand remains steady to slightly softer, while slaughterhouse activity has returned to normal following the Thanksgiving holiday. Average whole broiler prices are expected to remain stable in Q4, at a low level (-5% YoY). Exports are starting to recover, with full-year shipments projected to be down only 0.5% YoY.

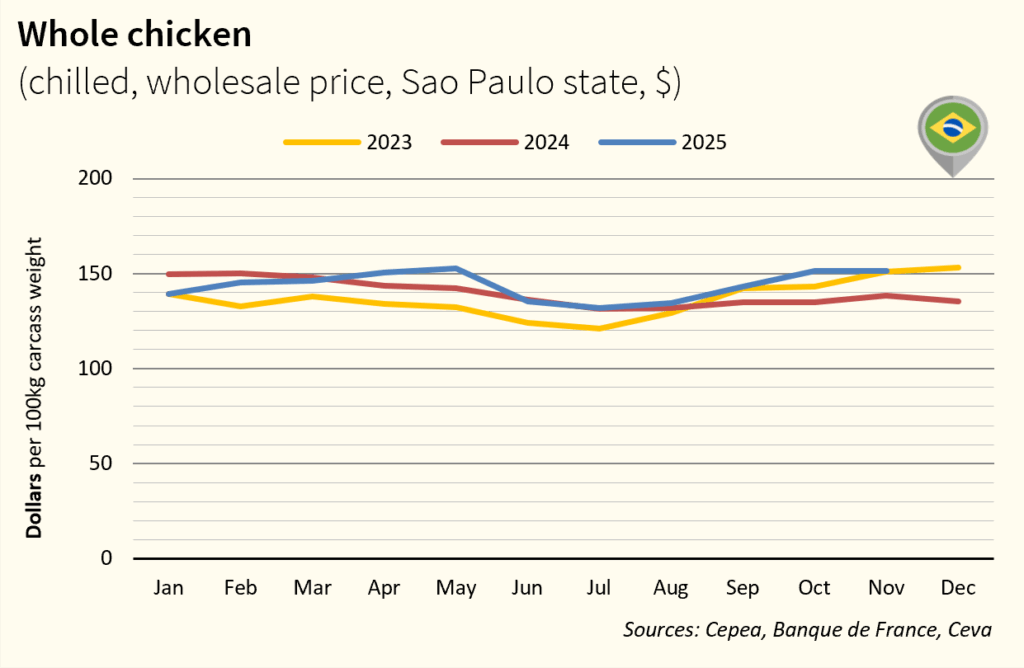

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

Chicken prices declined by a further 1%. Although market conditions remain broadly balanced, exports continue to put downward pressure on prices. Despite the recovery of shipments to most destinations, Brazilian sales in November were still down 8% YoY. Exports to China remain limited, as the market has yet to effectively reopen despite the lifting of the ban on Oct 31. In November, farmers’ margins continued to deteriorate (feed costs rose by 0.6% and chick prices by 8%). The 2026 outlook remains positive, with production expected to grow by 2.3%, exports to recover, and domestic consumption to reach a record 51.3 kg per capita.

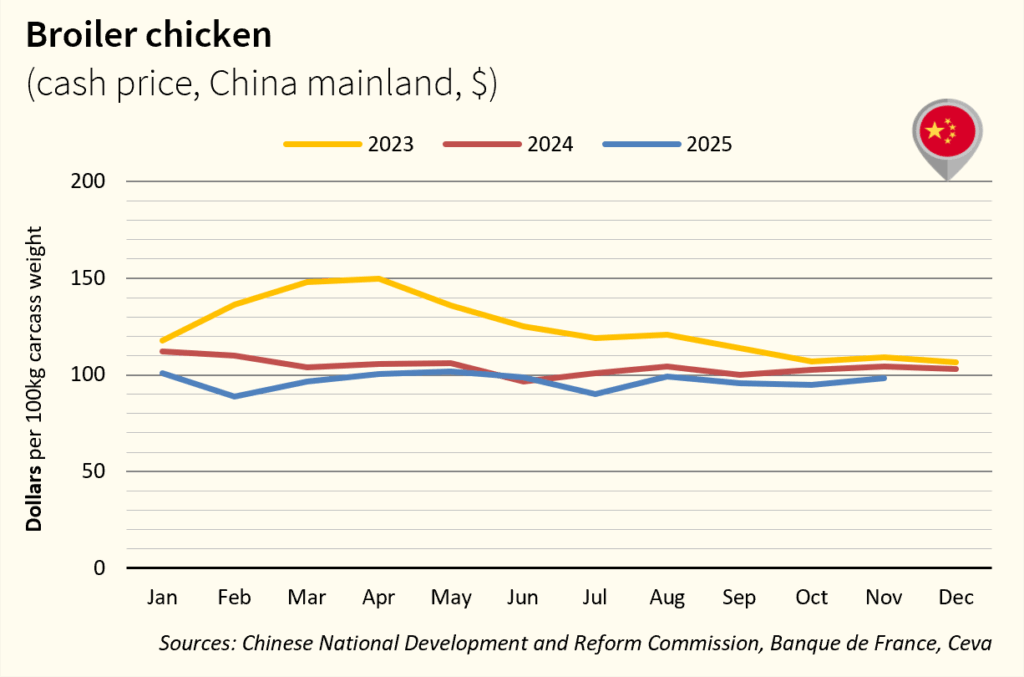

BROILER CHICKEN PRICE OVERVIEW – CHINA

Chicken prices increased by 3% after 2 conse-cutive months of decline. This rebound occurred in a context of slower slaughter activity and weaker demand, combined with a seasonal decline in average live weight per bird. At the same time, yellow-feather chicken prices fell by 4%. Production decreased by 2.4% vs. October but remained up 6% YoY. Prices were also supported by strong export activity, with shipments up 79% YoY in October, mainly to Russia and the Middle East.

POULTRY

POULTRY