Poultry Market Outlook -October

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

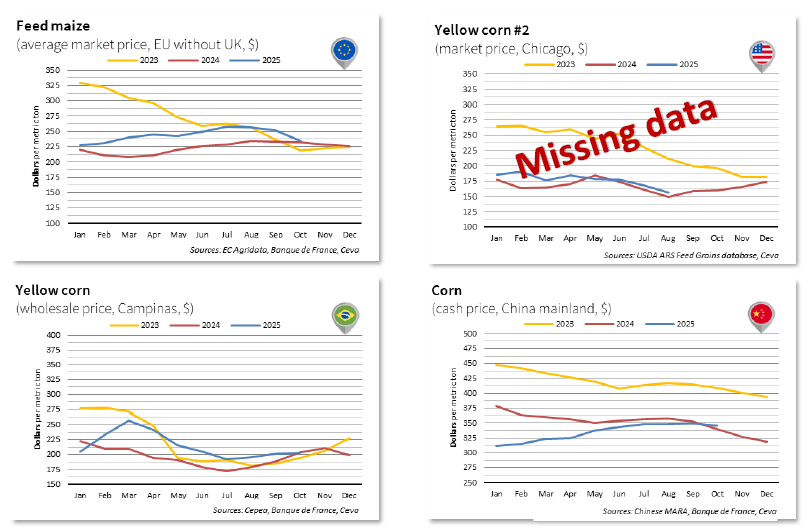

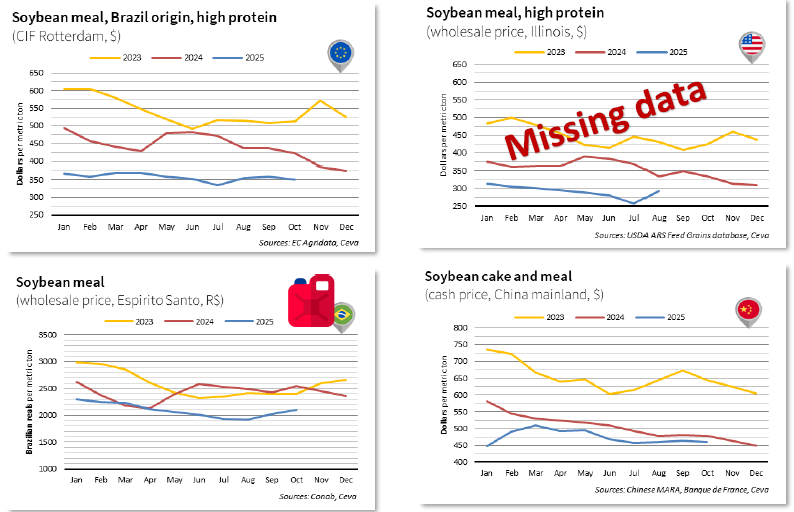

FARM INPUTS OVERVIEW – WORLDWIDE

On global markets, corn prices have generally continued to trend downward, in a context of abundant global supplies, particularly in the United States. Soybean prices, meanwhile, remain highly sensitive to developments in the trade discussions between US President Donald Trump and Chinese President Xi Jinping, with prices fluctuating accordingly.

Corn

- On the European market, corn prices fell sharply in October, reaching $201.4/t compared with $214.9/t in September. The progress of the harvest is putting downward pressure on prices, although results remain mixed and uneven across the territory.

- In Brazil, during the planting season, corn prices have shown little movement, averaging $202.3/t in October versus $201.0/t in September. They remain supported by strong export activit

- The federal shutdown paralyzed the US market in October. In the absence of official supply-and-demand data, market participants acted cautiously, and prices showed little movement

- In China, prices have been fluctuating within a narrow range, averaging $346.9/t since June. The Chinese harvest has been very satisfactory (295 Mt, +5.7% compared with the five-year average). The USDA also reports an increase in domestic consumption, contributing to overall price stability.

Soymeal

- On the European market, prices fell by $7/t, down to $351/t. This decline follows the downward trend observed in Chicago, where prices remain under pressure due to the continued absence of Chinese demand.

- In Brazil, soybean meal prices rose once again, reaching $391.3/t in October compared with $376.1/t in September, supported by sustained export activity.

- As with corn, the US soybean market was disrupted by the ongoing federal shutdown. After falling mid-month—at a time when US–China relations appeared to be taking a negative turn—soybean prices rebounded towards the end of the month, driven by renewed optimism regarding trade relations.

- In China, soybean meal prices declined. China has been importing very actively for several months and now holds comfortable stock levels, which has contributed to stabilising domestic prices.

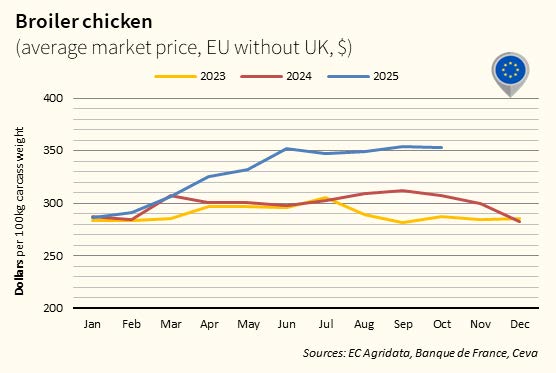

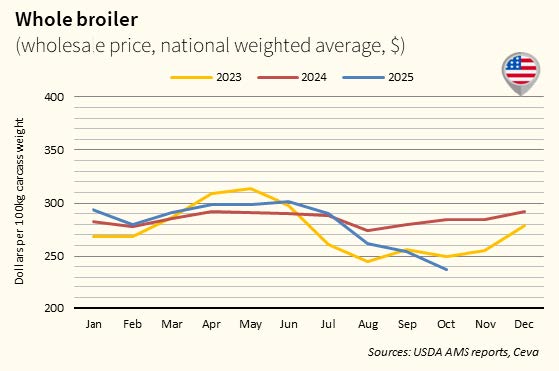

BROILER CHICKEN PRICE OVERVIEW – GLOBAL

In October, European prices remained elevated amid persistent supply tensions, while the recovery of supply in the United States weighed on prices. In Brazil, a recovery in export volumes, especially to the EU, supported price gains, whereas in China, oversupply and soft demand continued to pressure the market. Globally, HPAI remains a concern, with 471 outbreaks detected since July 2025, including 281 in Europe, raising vigilance ahead of winter.

BROILER CHICKEN PRICE OVERVIEW – EUROPE

EU broiler prices stabilized at a high level, supported by tight supply despite the gradual recovery of Polish production. Ongoing cons-traints in chick availability and the temporary suspen-sion of Brazilian imports (June–October 2025) continued to limit supply. Over the first ten months of 2025, EU poultry imports fell 5%, driven by a sharp decline from Brazil (-13%), partially offset by higher imports from Thailand (+13%) and China (+27%). A strong resurgence of HPAI outbreaks since October could weigh on production growth forecasts for the coming months.

BROILER CHICKEN PRICE OVERVIEW – USA

US broiler prices declined amid seasonally softer demand and adequate availability. HPAI cases resurged in autumn, particularly in turkey flocks and broilers. US exports remained constrained by the ongoing trade dispute with China and biosecurity concerns. A potential agreement between Beijing and Washington could support export recovery. Due to the federal shutdown, October foreign trade statistics were not released.

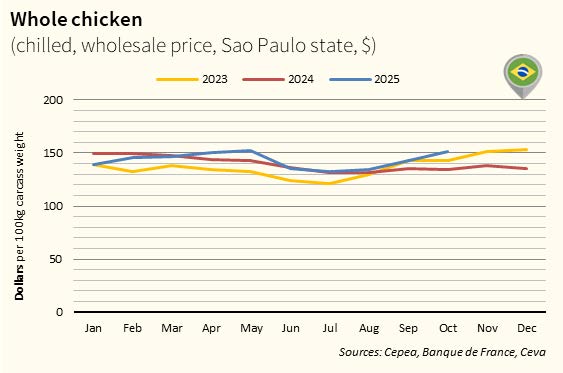

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

Broiler prices continued to strengthen, supported by the recovery of exports across most markets following the May HPAI outbreak, particularly shipments to the EU. However, prices remained below pre-HPAI levels due to seasonal weakness in domestic consumption and ample supply. Exports to China are expected to resume after more than 5 months of suspension, as China lifted its embargo on Oct. 31. Overall October exports increased 9%, driven by stronger sales to South Africa and South Korea.

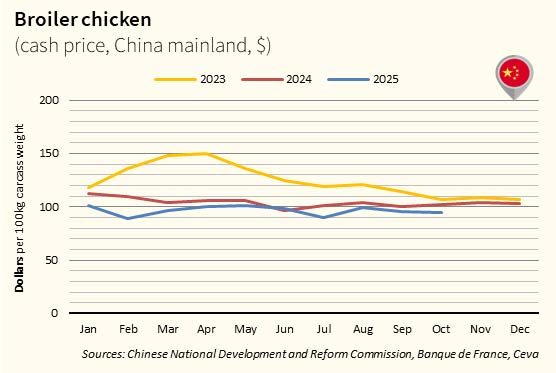

BROILER CHICKEN PRICE OVERVIEW – CHINA

Chinese broiler prices fell slightly despite strong demand during the National Day holiday. The sharp drop in demand during the second half of the month pulled prices lower, especially for white-feather broilers. Market conditions remain oversupplied, with weak consumption and high production levels. Chick prices continue to decline (-19% YoY), sustaining high output, although tight availability of breeder chicks in H2 2025 may constrain commercial chick placements in early 2026.

POULTRY

POULTRY