Poultry Market Outlook - May

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

In May, corn prices declined globally, except in China. U.S. prices dropped due to a strong planting pace and a weak dollar, while Europe followed with a slight dip. Brazil saw the sharpest fall, driven by excellent harvest prospects. In contrast, Chinese corn prices rose amid ongoing trade tensions with the U.S.

Soybean meal prices also fell in Brazil, the U.S., and Europe, reflecting strong supply expectations. However, the decline slowed in Brazil. China again diverged, with a slight price increase linked to persistent trade uncertainties.

Corn

- On the US market, corn prices unsurprisingly continued to decline, dropping from $184.6/t to $178.7/t in May. The weakness of the dollar continues to weigh on American products, as does the strong progress of planting, which is ahead of the 2024 pace.

- In the European market, corn prices are following the lead of their US counterpart and Euronext wheat, but in a more moderate manner. Prices reached $245/t from $246.8/t in April.

- The Brazilian market recorded the sharpest decline, falling to $215.4/t from $241.5/t the previous month. Harvests are progressing well, and the expected volumes are excellent: 131 Mt compared to a 5-year average of 118 Mt.

- Contrary to other markets, China saw its corn price rise in May (+$12.9/t) to reach $337.9/t. Despite ongoing negotiations between Beijing and Washington, tensions persist, which is supporting prices.

Soya and Soybean meal

- As with corn, soybean meal prices on the Brazilian market declined due to harvest progress and strong expected volumes. However, the downward trend observed for nearly a year has slowed. Brazilian soybean meal fell to $364.5/ton in May compared to $367.4/ton in April.

- In the U.S. market, soybean meal also declined, dropping from $294.9/ton to $289.1/ton. Expectations of a very comfortable global supply are weighing prices, although discussions around soybean oil blending volumes for biodiesel production have caused volatility across the entire soybean complex.

- On the European market, soybean meal prices fell by $11.6/ton in one month, following the trend set by its two major trading partners.

- The Chinese market did not follow this overall downward trend. Soybean meal recorded a slight increase in May (+$1.4/ton), supported by ongoing uncertainties surrounding U.S.-China trade relations.

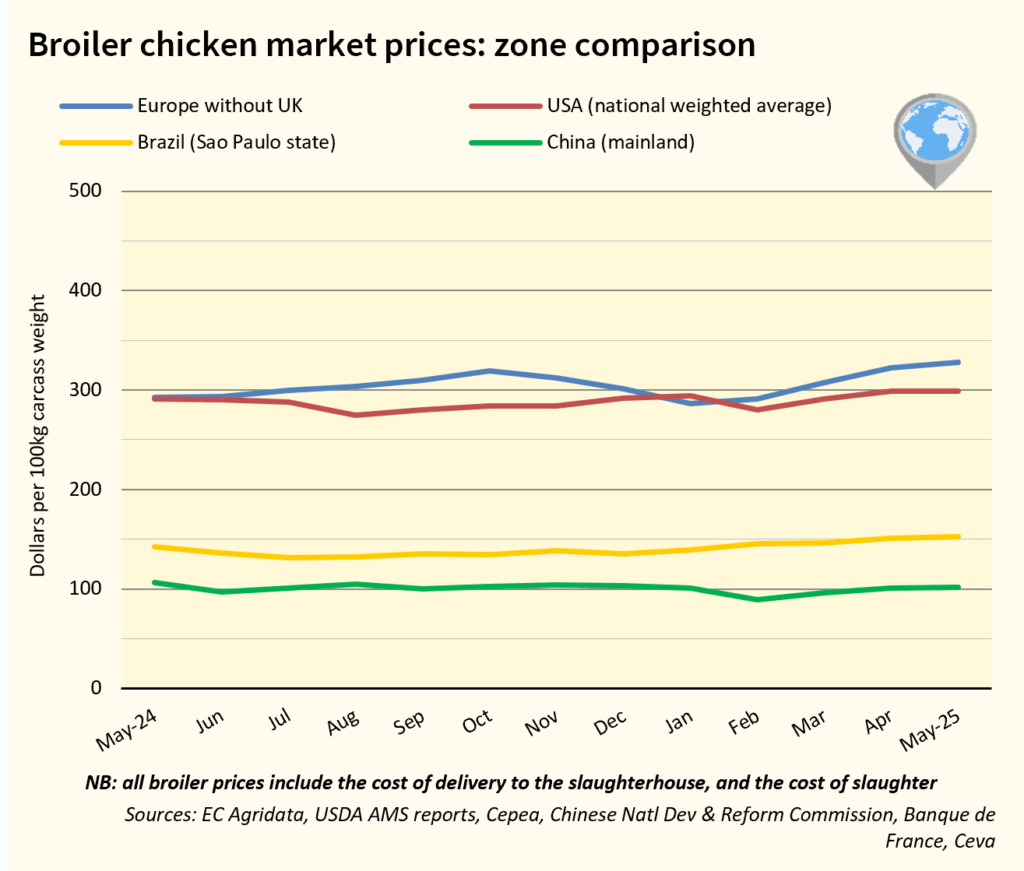

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

In May, the global poultry market felt the impact of HPAI in Brazil, leading to increased supply tensions and rising prices, reaching record levels in Europe. Global supplies are expected to remain tight in the coming months, with high prices and declining trade volumes, as flows shift and substitute away from Brazil to other suppliers. However, demand is expected to remain strong, particularly in Asia, the Middle East, and Europe.

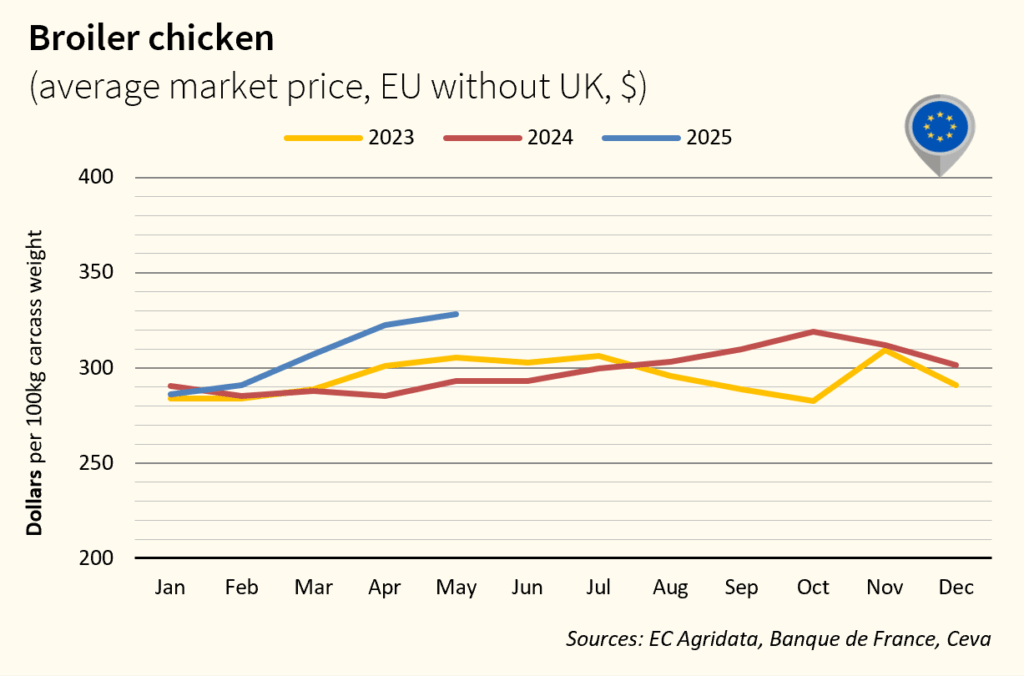

BROILER CHICKEN PRICE OVERVIEW – EUROPE

In May, chicken prices in Europe reached an all-time high, driven by ongoing HPAI outbreaks in Poland and Hungary, declining production in the Netherlands, and strong demand. The EU market has also been cut off from Brazilian imports (a loss of around 22,000 tonnes of chicken per month) due to the HPAI situation in Brazil, adding further pressure to already tight supplies since last year. Chicken prices are expected to remain high in the coming months.

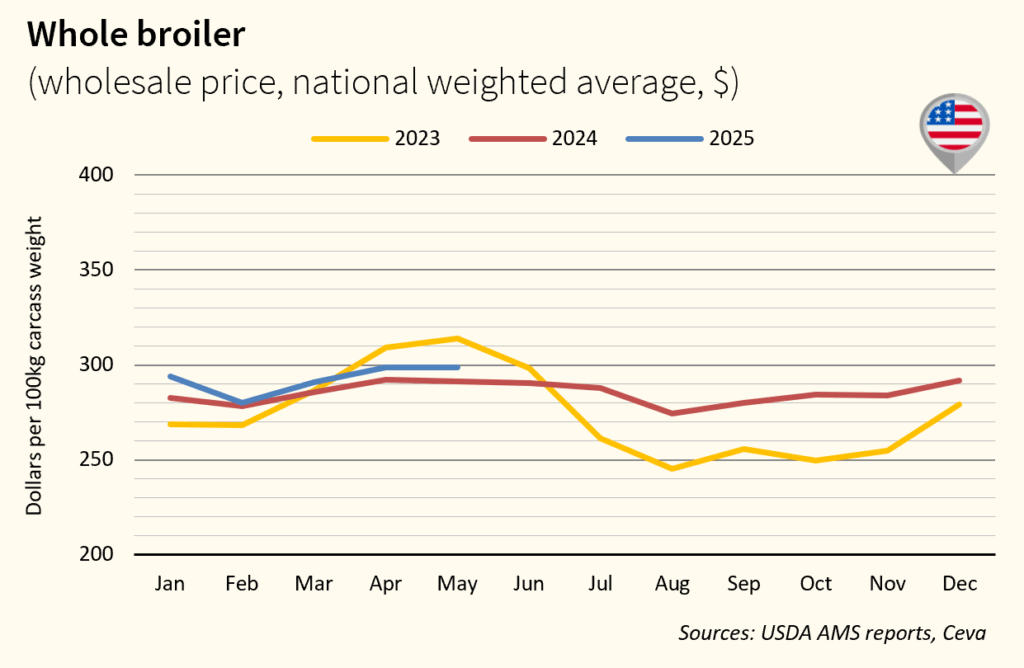

BROILER CHICKEN PRICE OVERVIEW – USA

In the U.S., chicken prices remained relatively stable in May, supported by rising production despite ongoing HPAI cases, which have mainly affected the egg sector. Supply and demand stayed broadly balanced, although exports declined in some markets due to HPAI and trade tensions, particularly with China. However, in June, Chinese authorities reapproved several U.S. slaughterhouses for export, a move accelerated by ongoing U.S.-China negotiations and the halt of imports from Brazil, which has recently strained China’s supply. A price stabilization, or even a slight increase is expected in the coming weeks.

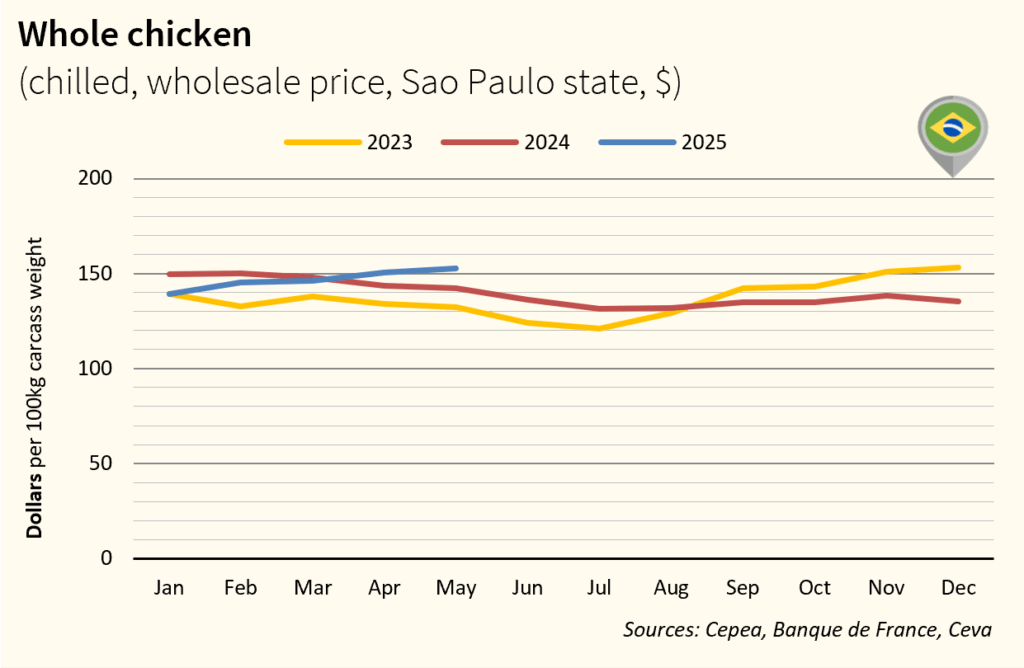

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

In May, chicken prices in Brazil declined slightly. Following the detection of HPAI in a poultry farm, export demand dropped sharply as over 20 trade partners (representing two-thirds of Brazil’s poultry exports) closed their markets. This led to downward pressure on domestic prices, which are expected to continue falling, further eroding farmers’ profitability. However, no new outbreaks have been reported in the past 28 days, and Brazil may soon regain its HPAI-free status, potentially reopening access to currently closed export markets.

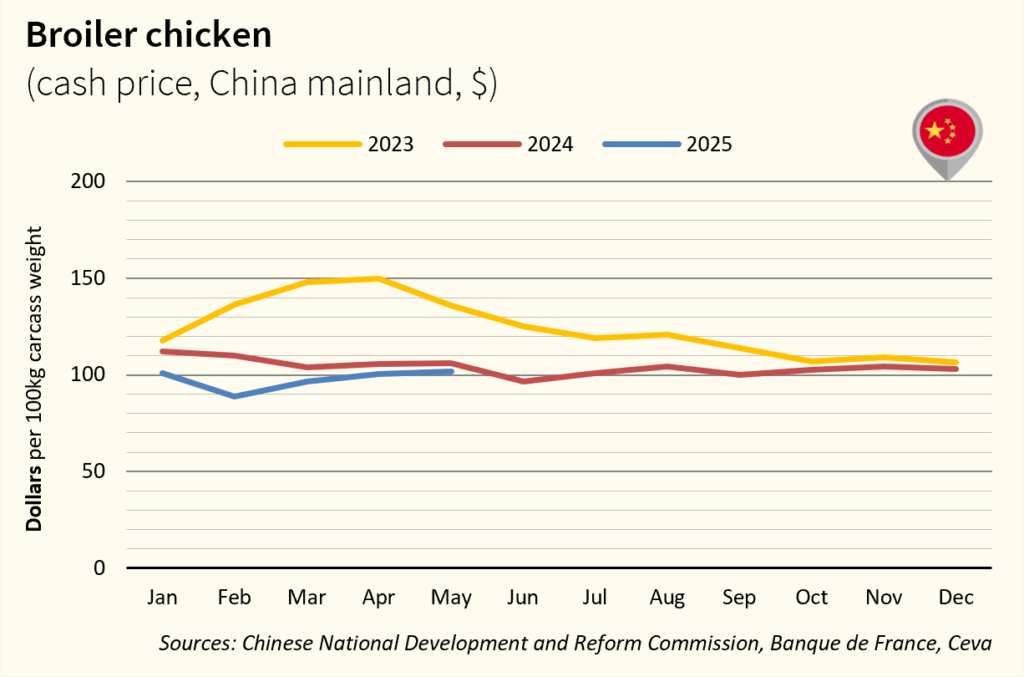

BROILER CHICKEN PRICE OVERVIEW – CHINA

In May, chicken prices in China remained relatively stable, supported by steady demand. However, supplies have started to tighten, particularly after the suspension of Brazilian imports for 60 days (a volume equivalent to 40,000 tonnes per month). This has affected availability, and prices began to rise in early June. The recent reapproval of several U.S. exporters is expected to ease supply pressures in the coming weeks, with import volumes recovering. A price relaxation is likely by the end of the summer.

POULTRY

POULTRY