Poultry Market Outlook - July

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

As the northern hemisphere harvests approach for the 2025/26 campaign, and soybean and corn harvests advance in the southern hemisphere, commodity prices remain on a downward trend despite an uncertain geopolitical context that could generate volatility. Supply prospects appear satisfactory, while demand remains relatively subdued.

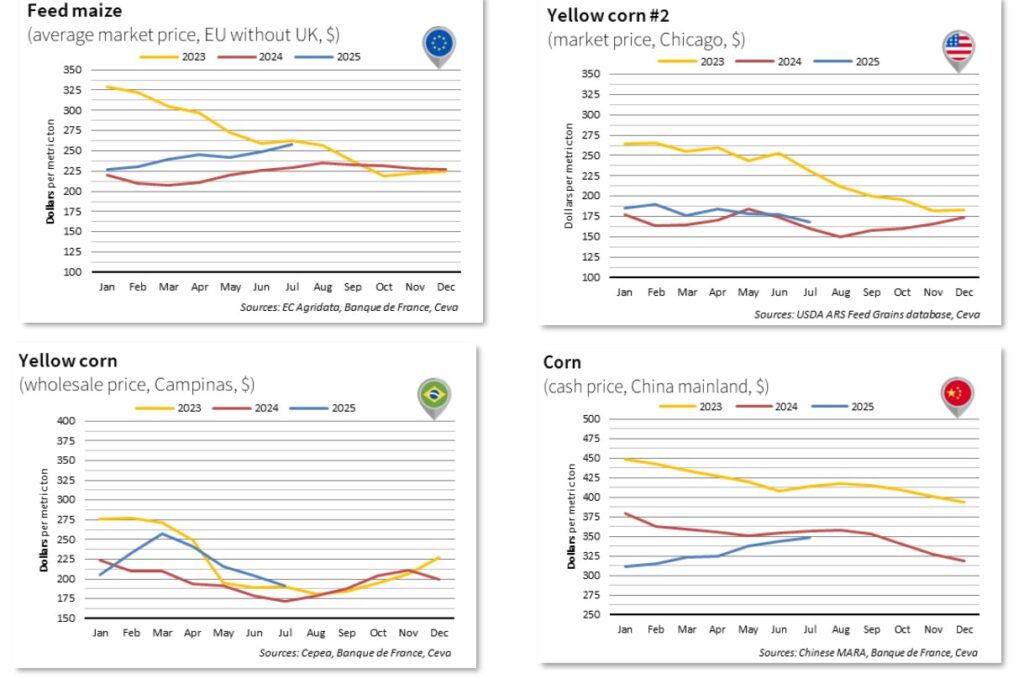

Corn

- Corn prices have stabilized on the US market, at $177.2/t compared to 178.7/t in May. The progress of harvests in South America put downward pressure on prices during the second half of June. US corn is now trading close to 2024 prices.

- The advancement of the Safrinha harvest in Brazil is pushing local prices down. The total Brazilian corn harvest is expected to reach an excellent level this campaign, at 131 Mt compared to a five-year average of 118 Mt. In June, corn prices fell to $204.7/t compared to $215.4/t in May.

- In euros, corn prices on the European market stabilized in June at €217.8/t (€216.9/t a month ago). The downward influence of the US and the Brazilian corn was partially offset by a temporary increase in oil prices in mid-June.

- The Chinese market recorded a slight increase of +$5.7/t in June, supported by uncertainties surrounding the future trade agreements with the United States.

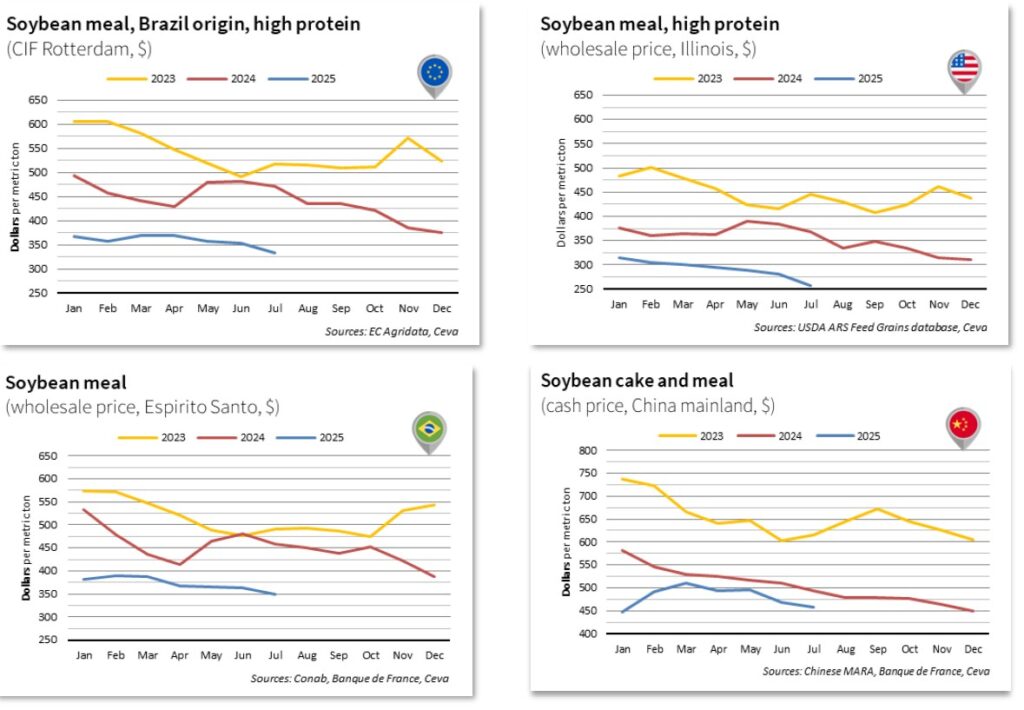

Soya and Soybean meal

- On the Brazilian market, soybean meal continues its decline, driven by falling soybean prices as the harvest progresses. In June, soybean meal traded at $362.6/t compared to $364.5/t in May, nearly $120 lower than in 2024 ($481.2/t in June 2024).

- US soybean meal followed the same downward trend, with a sharper decrease from $289.1/t in Ma to $280.7/t in June. Crushing activity remains very strong in the United States, supported by attractive soybean prices and robust demand for oil from the biofuel sector.

- The European market mirrors its counterparts across the Atlantic. Soybean meal fell by $5, reaching $353.0/t in June, its lowest level since June 2020.

- Upward revisions in Brazilian production and export forecasts are reassuring the Chinese market, where soybean meal prices fell significantly over the month: $468.6/t compared to $494.6/t in May. With rising production and expanding export capacity, Brazil appears capable of meeting Chinese demand.

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

In July, market fundamentals remained strong with stable feed costs and dynamic demand. However, political tensions and the ongoing trade dispute with the U.S. continue to weigh on the global economy and could reshape trade flows. While the avian influenza situation appeared under control over the summer, uncertainty remains regarding HPAI developments this autumn. Growth forecasts for broiler production have been revised downward, with output now expected to increase by less than 2% in 2025.

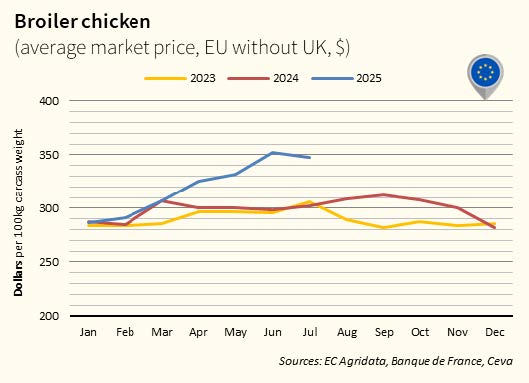

BROILER CHICKEN PRICE OVERVIEW – EUROPE

In July, seasonal demand slowdown eased price pressure, with broiler prices declining by 2.7%. Despite this, upstream tensions persist, as live bird prices reached a new record high of €1.38/kg live weight, amid shortages of live birds and day-old chicks. Early signs of supply recovery are emerging, with broiler prices from Poland down 7%. Demand is expected to remain firm while supply remains constrained through the second half of 2025, despite positive production growth prospects. EU imports rose by 15% over the first seven months of 2025.

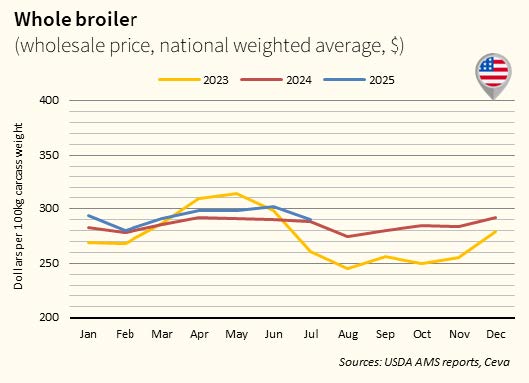

BROILER CHICKEN PRICE OVERVIEW – USA

In July, U.S. broiler prices fell 4% amid soft seasonal demand. Supply remains abundant, particularly for breast meat, leading to price concessions. The avian influenza situation has calmed, with only one outbreak reported in July. Exports declined 7% in the first seven months of 2025 but began to recover in July thanks to renewed shipments to Taiwan and the Philippines.

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

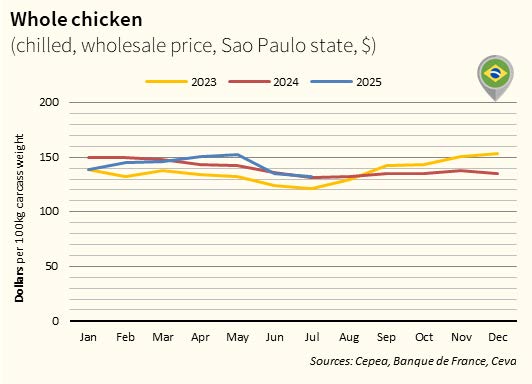

In July, Brazilian broiler prices continued to decline, standing at the same level as July last year. This marks the third consecutive monthly drop, mainly due to HPAI cases and the closure of certain export markets. This has resulted in oversupply in the domestic market. Exports decreased further in July (-14%), despite some recovery in shipments to specific destinations. The EU and Chinese markets remain closed.

BROILER CHICKEN PRICE OVERVIEW – CHINA

In July, broiler prices kept falling amid oversupply, especially of white-feather birds, and weak demand. This situation has severely impacted chick demand, which collapsed, forcing some producers to cull breeder flocks prematurely. These drastic measures are expected to reduce supply in the coming months, potentially creating shortages from September onwards. Indeed, in early August, chick prices surged dramatically, with increases of up to 180% in some regions.

Chinese market data with graph is missing. Our apologies for that.

POULTRY

POULTRY