Poultry Market Outlook - December

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

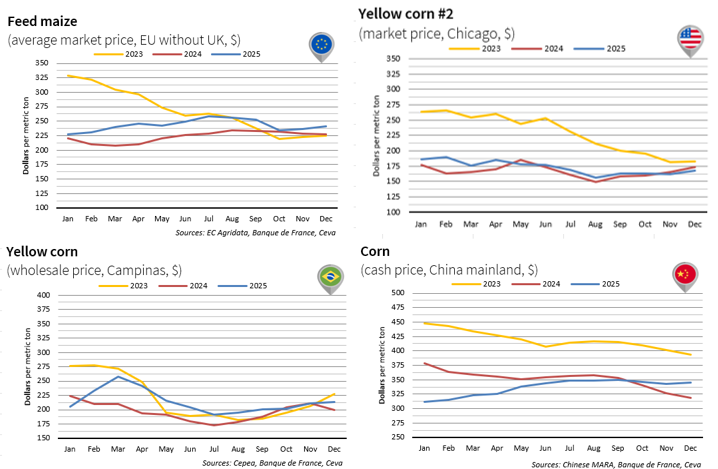

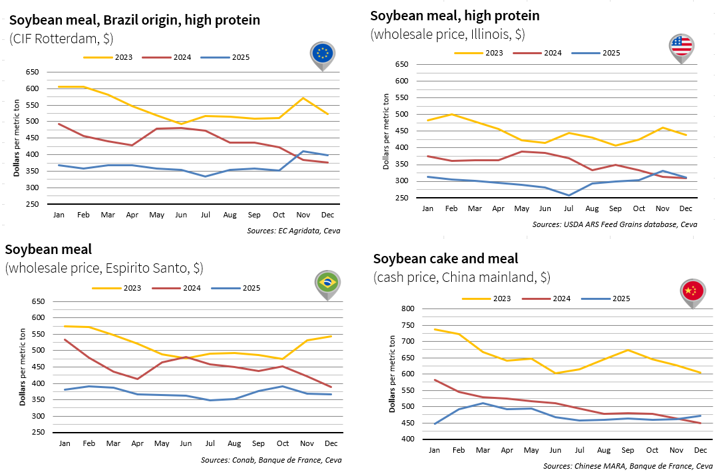

FARM INPUTS OVERVIEW – WORLDWIDE

In December, the corn market followed an upward trend worldwide. This momentum was driven by a combination of factors, including strong export demand, weather-related uncertainties and supply chain delays. As for soybeans, the most notable development at year-end was the postponement of China’s commitment regarding its imports of US soybeans. This announcement weighed heavily on US prices and, indirectly, on the European market. The approaching harvests in South America also contributed to this downward trend.

Corn

- In the United States, corn prices continue to be supported by very strong export sales. Prices increased by $5.5/t over the month, reaching $167.3/t. According to the USDA, US corn exports are expected to exceed 200 Mt this campaign, representing an 8% increase compared with the five-year average.

- In Brazil, corn prices remained on an upward trend in December. Weather conditions in the south of the country are not optimal, with a significant lack of rainfall for several months. Corn prices therefore stood at $212.9/t, compared with $210.8/t in November.

- On the European market, prices also increased, driven by delays in the Ukrainian harvest, which have slowed exports to the EU-27. Corn was traded at $240.6/t, up 1.6% compared with November.

- Finally, in China, prices have shown little movement since July, averaging $346.4/t over the period ($344.9/t in December). The market remains relatively balanced despite a production shortfall of around 20 Mt this campaign, according to the USDA. The size of existing stocks helps to regulate prices.

Soya and Soybean meal

- On the US market, soybean prices fell sharply following China’s announcement that it would postpone its target to purchase 12 Mt of US soybeans by the end of 2025. Although a new deadline has been set for February 2026, this was not sufficient to support prices. As a result, US soybean meal prices declined by $19.0/t over the month, falling to $311.9/t.

- In South America, the 2026 harvests are approaching and are expected to be very satisfactory. Against this backdrop, soybean meal prices continued to decline on the Brazilian market, standing at $367.6/t in December.

- The European market followed trends seen across the Atlantic, with soybean meal prices dropping by $12.0/t over the month and falling back below the $400.0/t threshold.

- In China, soybean meal prices remained supported by ongoing uncertainties surrounding US supply, reaching $472.0/t in December, compared with $462.6/t in November.

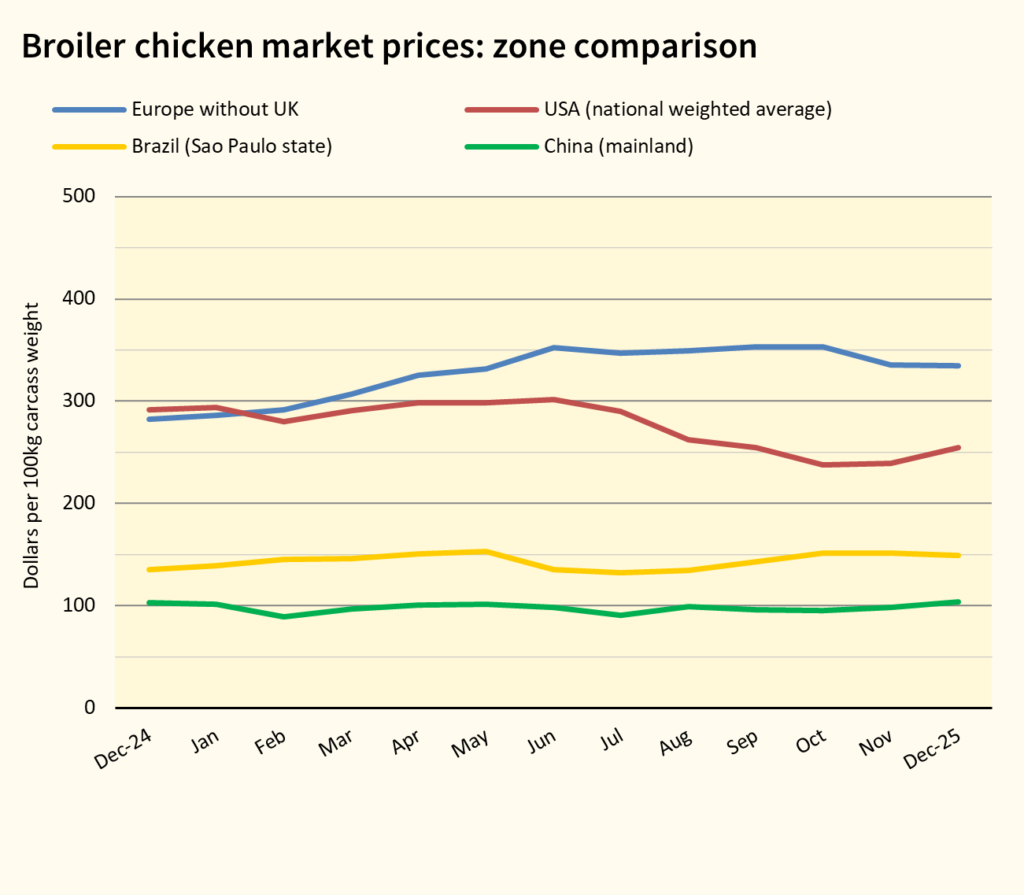

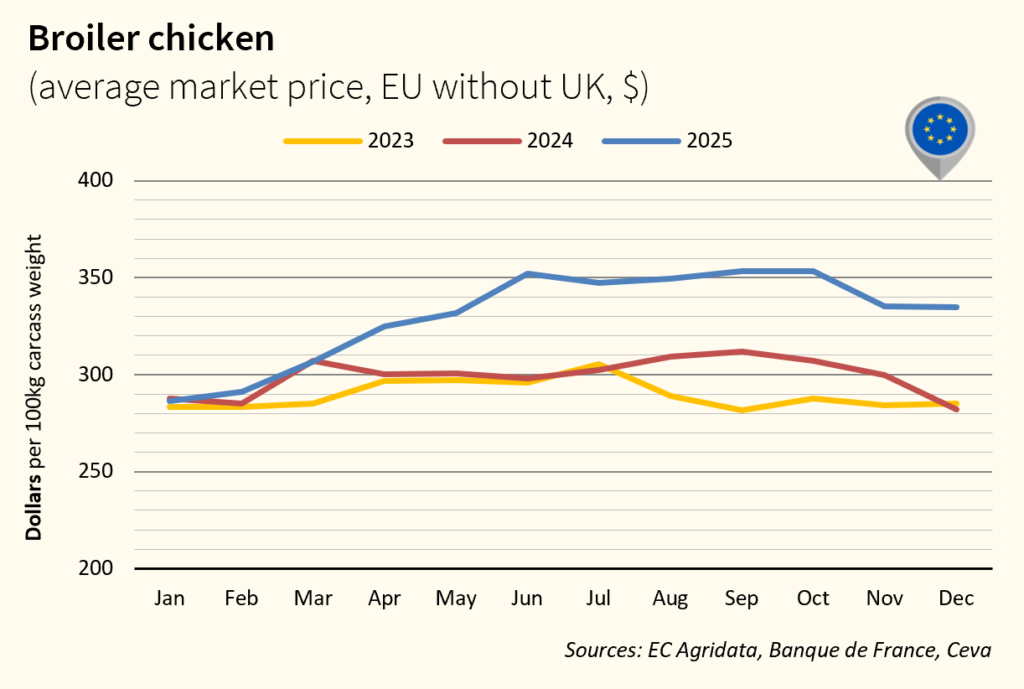

BROILER CHICKEN PRICE OVERVIEW – GLOBAL

In December, the year ended with firmer broiler prices in several key regions, notably the USA and China, supported by solid demand. Market signals remain positive. In contrast, prices in Europe declined due to the return of Polish supply and higher imports, particularly from Brazil. HPAI continues to weigh on production conditions in Europe and the US. For 2026, global broiler production is expected to grow by around +2.5%, mainly driven by Latin America and Asia. Europe and North America are expected to show more cautious growth, reflecting ongoing animal health risks and uncertainties around trade policies.

BROILER CHICKEN PRICE OVERVIEW – EUROPE

In December, broiler prices continued to decline, driven by the full recovery of Polish production and improved chick availability. Demand remains strong, supported by high inflation on competing proteins such as beef and eggs. However, renewed HPAI outbreaks and Newcastle disease cases in Poland are limiting growth prospects for 2026. Poultry imports increased sharply in December (+37%) in a context of supply tightness. Imports from Brazil rebounded strongly (+77%), while shipments from Thailand and Ukraine rose by +34% and +68% respectively.

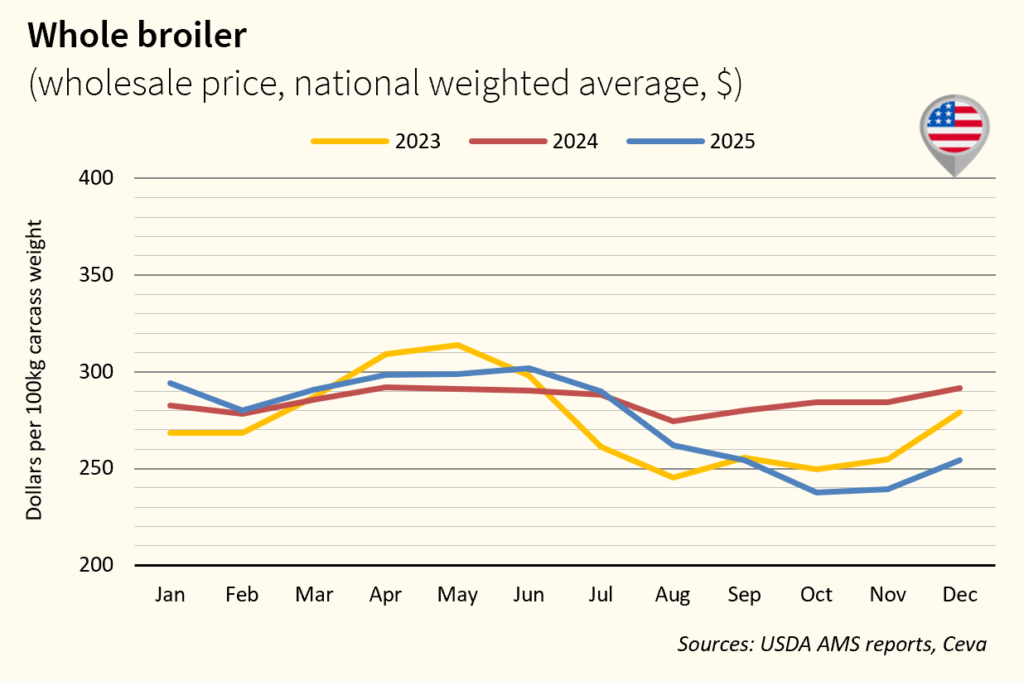

BROILER CHICKEN PRICE OVERVIEW – USA

US broiler prices recovered in December, although they remain about 13% below year-ago levels, despite higher production in Q4. HPAI-related disruptions and stronger year-end demand supported the recent price rebound. Processing activity remains balanced, with good demand for breast meat and tenders, while demand for dark meat remains weak. December exports were stable, with strong growth to Taiwan (+52%). Exports to China remain blocked amid ongoing trade tensions.

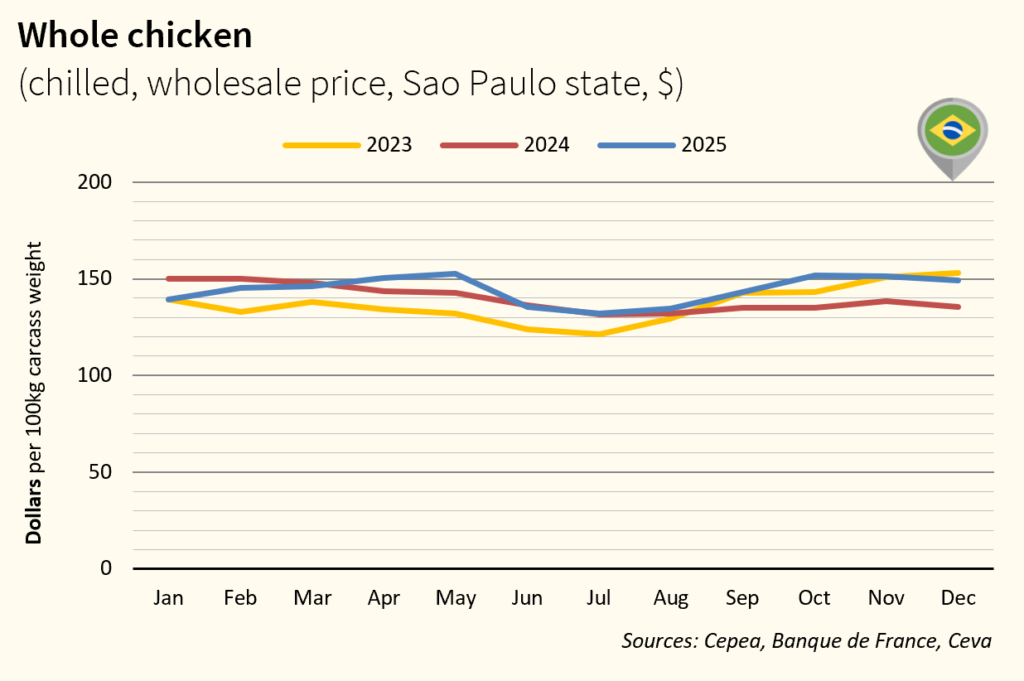

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

In December, chicken prices edged up slightly in the domestic market, supported by stable production costs and improving exports. In US dollar terms, prices declined, supported by the depreciation of the Brazilian real, which strengthened Brazil’s export competitiveness. Following a solid performance in 2025 despite isolated HPAI cases, Brazil is expected to reach new records in 2026, with production forecast to rise by around 2% and exports by 3%. External demand continues to grow, particularly in the Middle East and Asia, with prospects for a partial recovery of shipments to China.

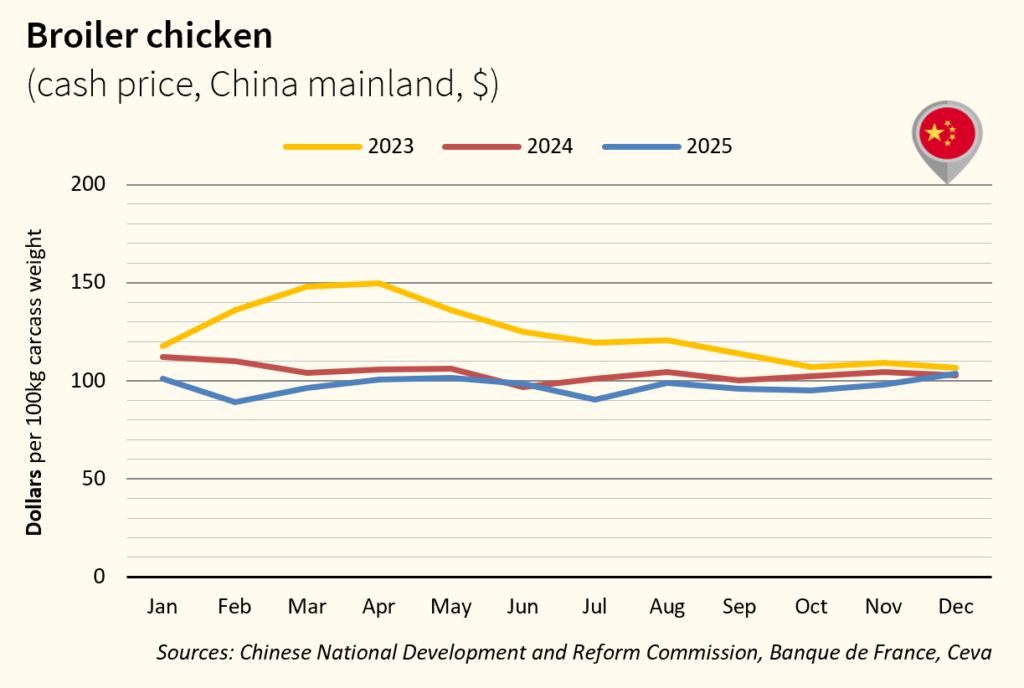

BROILER CHICKEN PRICE OVERVIEW – CHINA

In December, broiler prices in China continued to increase (+5%) but have not yet returned to year-ago levels. This rebound follows several months of decline in a context of oversupply, as production increased by about 7% in Q3 2025. Market correction is underway, with lower slaughter volumes observed in December. The production surplus in 2025 weighed on company profitability and is expected to limit investment and slow production growth in 2026. China’s imports fell sharply in December (-73%), reflecting the suspension of Brazilian shipments. For the full year 2025, imports declined by 35%, while exports surged by 62%. As a result, China recorded for the first time a poultry trade surplus exceeding 200,000 tonnes..

POULTRY

POULTRY