Poultry Market Outlook - Aug

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

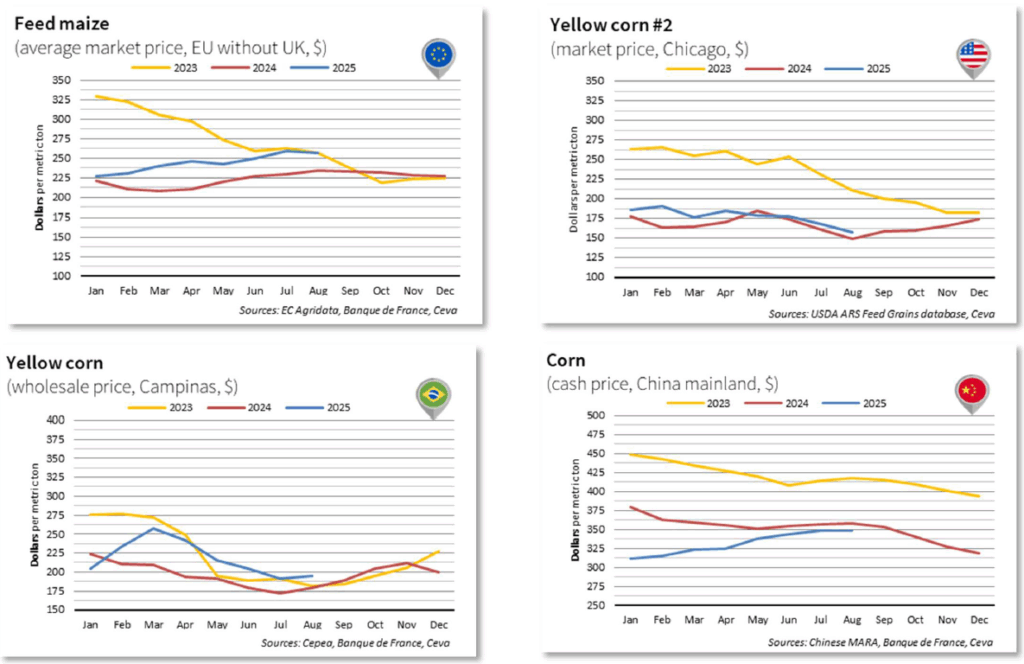

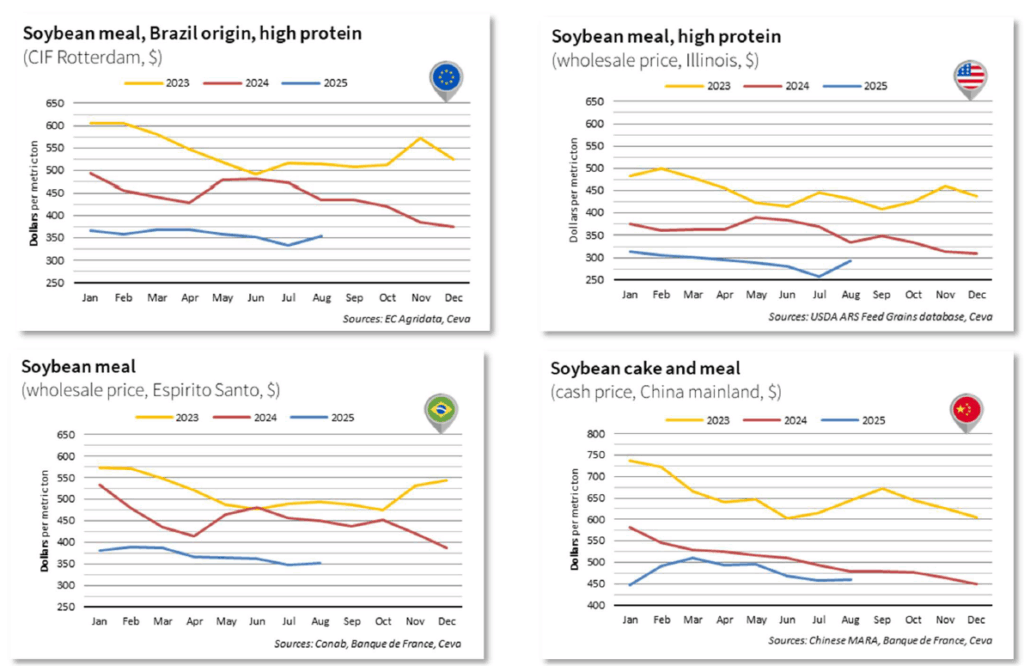

FARM INPUTS OVERVIEW – WORLDWIDE

Global grain and oilseed markets showed diverging trends in August. While US corn prices slumped under the weight of record production forecasts, European markets proved more resilient, and Brazil experienced a modest upswing. In parallel, soybean meal prices surged in the United States and, to a lesser extent, in Brazil and the EU,

whereas Chinese markets remained largely stable. These movements reflect both seasonal harvest dynamics and ongoing trade developments, particularly the renewal of the tariff truce between Washington and Beijing.

Corn

- U.S. corn prices continued their decline, falling to $156/t in August (-7%). The latest USDA report pointed to a record output of 425 Mt, which weighed on prices.

- In Brazil, prices adjusted upwards while the Safrinha harvest is in full swing. Corn reached $195.2/t compared with $191.7/t. This increase is explained by farmers’ withholding strategies as well as expectations of stronger demand for ethanol production.

- European corn prices recorded a slight drop (- $2.1/t), showing resilience despite uncertain harvest prospects following the July heatwave.

- In China, corn prices remained broadly unchanged, stabilising at $348.1/t. This stabilisation marks a pause in the upward trend observed since the beginning of

the year. The renewal of the tariff truce with the United States has brought some relief.

Soymeal

- In the United States, soybean meal recorded a sharp increase in August (+13.3%). The extension of the tariff truce with China supported prices, alongside stronger sales and prospects of increased demand for vegetable oils. Prices were also underpinned by President Trump’s statement expressing his wish for China to

quadruple its imports of US soybeans. - In the Brazilian market, soybean meal prices also moved higher (+ $2.9/t), driven by strong sales and the upward trend in US prices.

- In the European Union, prices followed the transatlantic trend. In August, soybean meal traded at $354.0/t compared with $334.0/t in July.

- As with maize, soybean meal prices showed little movement on the Chinese market, standing at $459.6/t in August against $458.1/t in July.

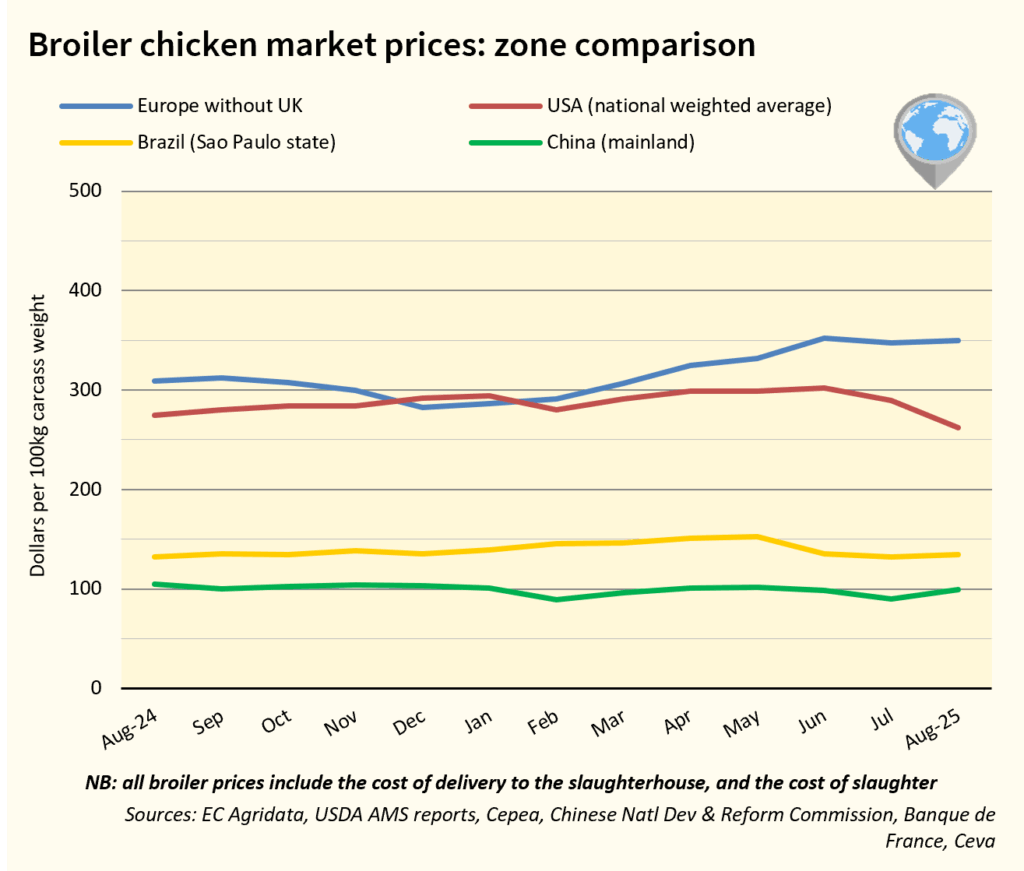

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

In August, poultry prices edged up slightly, with regional disparities. While the EU, Brazil, and China recorded price increases, US prices moved downwards. Global demand remains strong, but supply chains are under pressure. Production outlooks stay positive (+2%), with EU output gradually recovering thanks to Poland’s return to production and easing tensions on chick availability.

Brazilian exports are also resuming, particularly towards the EU, which now considers Brazil free from HPAI. However, the risk of HPAI continues to weigh on the sector, with the first new cases reported in Spain this autumn.

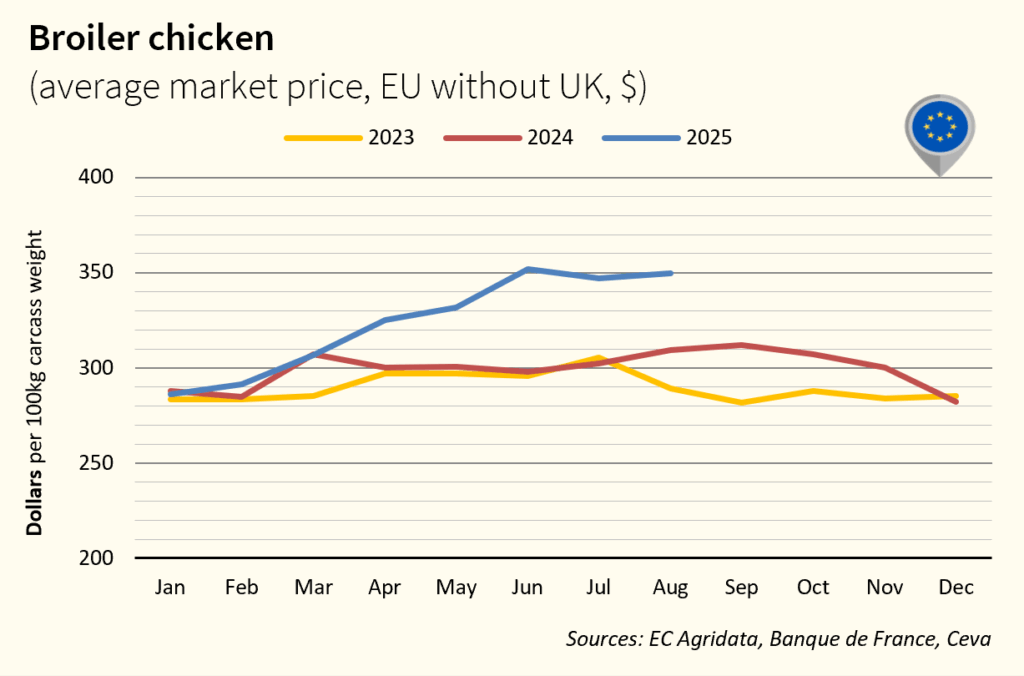

BROILER CHICKEN PRICE OVERVIEW – EUROPE

EU broiler prices rose again, supported by strong demand, restricted supply, the halt of Brazilian imports, and a reduction in imports from Ukraine.

This has tightened the market, redirecting demand towards EU-origin chicken. Production prospects for S2 remain positive, with a forecasted 3% increase. Since September 19, Brazil has regained access to the EU market, which should bring some relief. Nevertheless, the detection of HPAI cases in Spanish breeder flocks is expected to weigh on chick availability, slowing down the recovery.

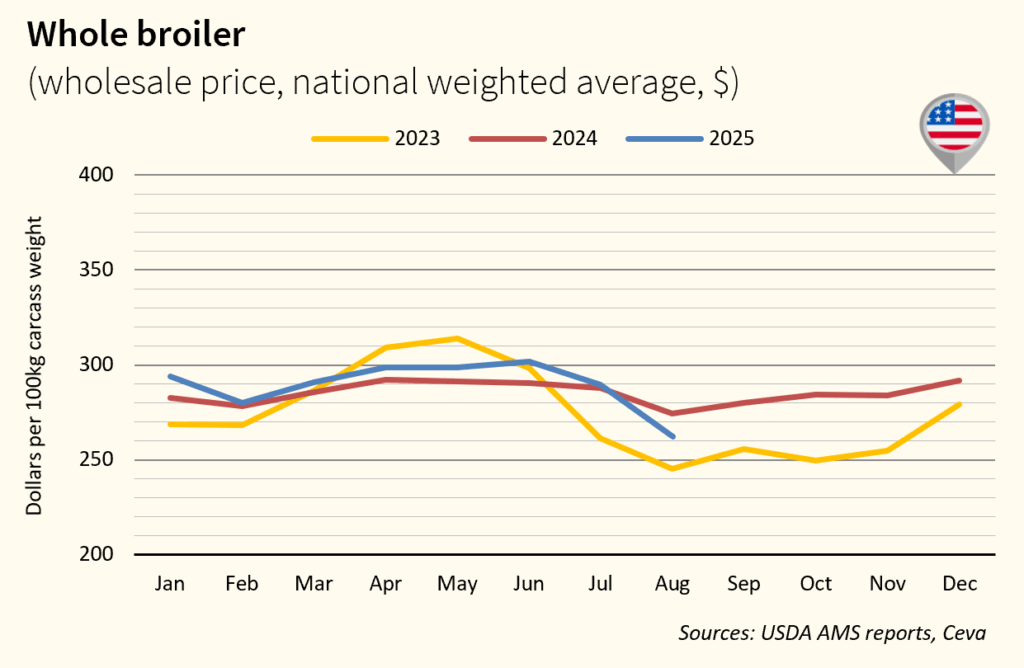

BROILER CHICKEN PRICE OVERVIEW – USA

In August, US broiler prices fell by 10%, reaching a two-year low. Higher production, USDA’s very positive outlook for hatchery and broiler output, and abundant supply against softer demand are weighing heavily on prices. Export activity remains limited, despite some recovery in Asian markets (Taiwan, the Philippines).

US exports to China remain weak, continuing to drag down overall trade performance.

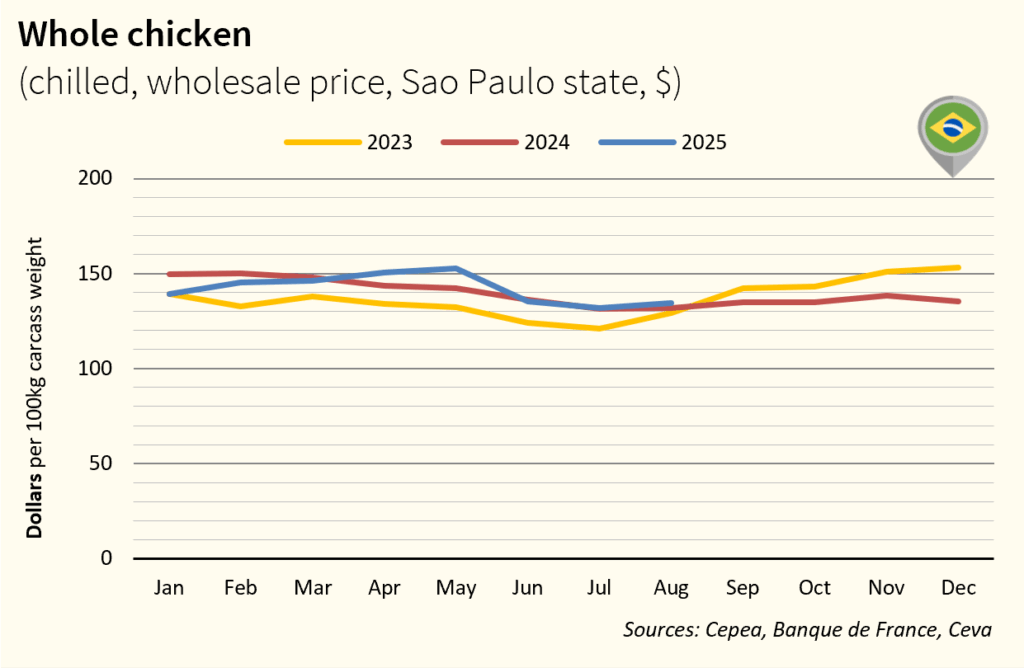

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

Brazilian broiler prices stabilized after three consecutive months of decline linked to HPAI and weaker export activity. Stabilization reflects the gradual resumption of exports to certain markets and the development of new markets (Mexico, Africa), while awaiting the reopening of Chinese and European markets.

On September 19, the European Commission lifted its embargo, paving the way for a gradual recovery of exports.

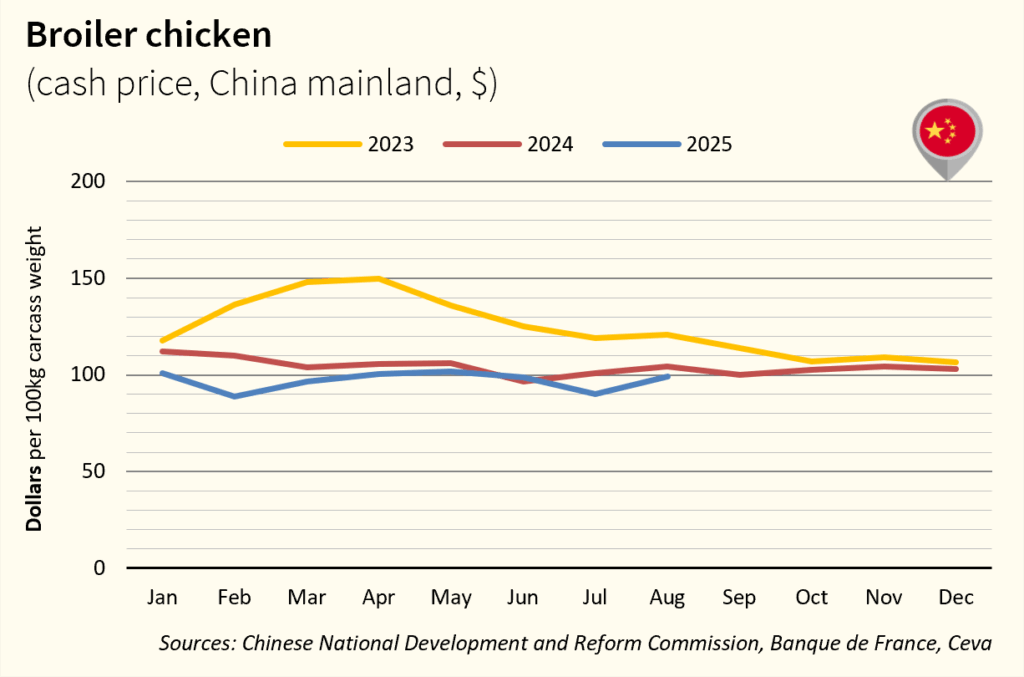

BROILER CHICKEN PRICE OVERVIEW – CHINA

Chinese broiler prices rebounded after a sharp drop in July. The recovery was driven by a 3.6% fall in production and reduced chick placements, with day-old chick prices surging 117% month-on-month.

Live bird supply remained tight, especially from mid-August onwards. Imports from Brazil remained blocked, with volumes down by 35,000 tonnes for the month. Despite

stronger demand, prices are expected to stabilize in September as operators look to clear stocks accumulated in previous months.

POULTRY

POULTRY