Poultry Market Outlook - April

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

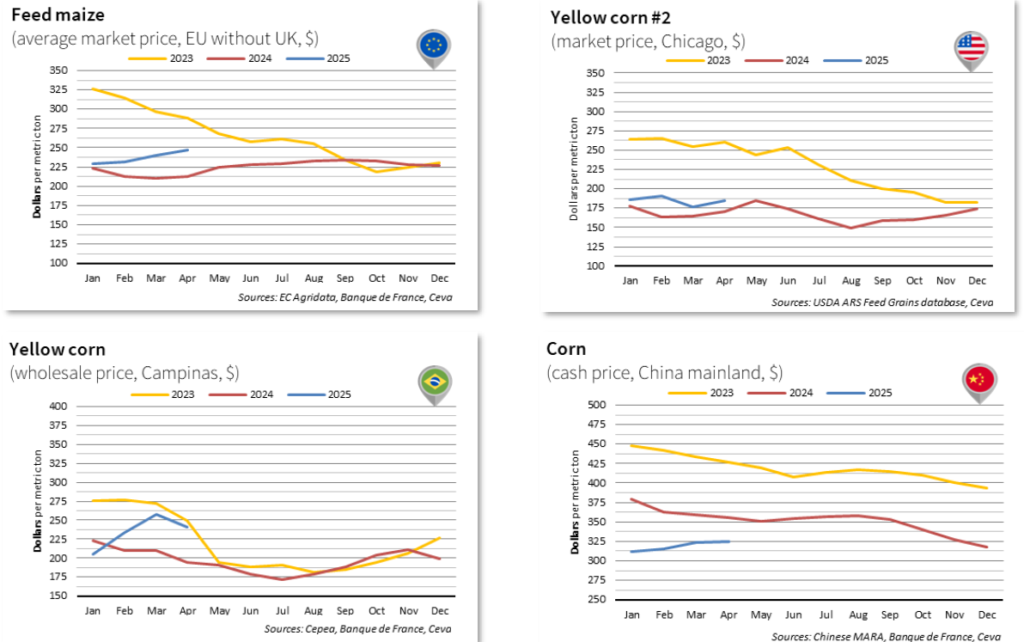

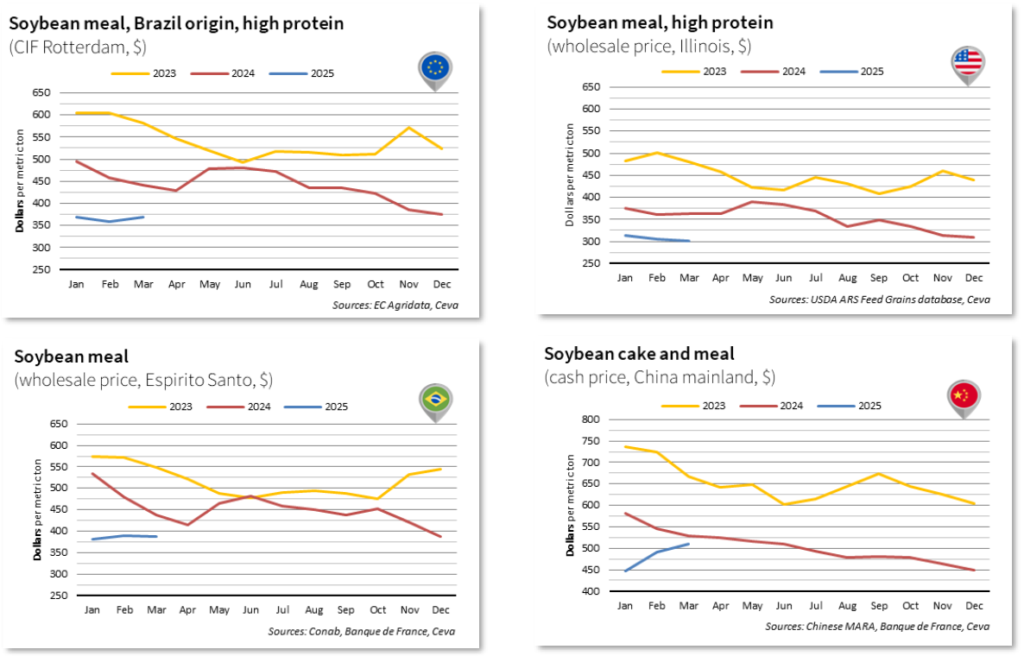

FARM INPUTS OVERVIEW – WORLDWIDE

Markets generally moved in unison over the month of April. Corn prices found support, particularly on the U.S. market where export activity remained strong. Brazil was the only country to see its prices decline. As for soybean meal, a general downward trend was observed, because of growing trade tensions and the progress of the Brazilian harvest.

Corn

- On the US market, corn prices have started to rise again after last month’s decline. Donald Trump’s announcements on 2 April boosted demand for US corn for two mains reasons: a gain in competitiveness due to the fall of the dollar, and exceptional purchases by importers looking to secure supplies before retaliatory measures come into effect. This renewed export activity supported prices.

- Brazil saw a sharp drop in corn prices (-$16/t), made possible by the progress of the safrinha harvest, the country’s first of the year.

- The increase seen on the European market is explained by the rise in the euro/dollar exchange rate. In local currency, corn prices fell by €2/t, dragged down by the levels seen on the US market.

- In China, corn prices changed little ($325/t vs. $323.5/t in March). Growing tensions between Beijing and Washington added pressure on the Chinese market.

Soymeal

- On the Brazilian market, soybean meal prices continued to fall (-$20/t over the month), driven down by the progress of the harvests.

- The US market is also trending downwards. The retaliatory measures announced by China are raising concerns about a loss of export opportunities for the soybean complex. These prospects are unsettling market players and putting downward pressure on prices.

- In the EU, prices also declined in April, falling to €329/t from €341/t in March. As a net importer of soybean meal, the European market closely follows overseas markets.

- In China, soybean meal prices dropped significantly in April ($17/t). Unlike corn, the geopolitical context has had led impact on soybeans. China plans to rely more on its South American partner, Brazil, with whom it has built strong trade ties over the past several years, offering a reliable alternative to US soy.

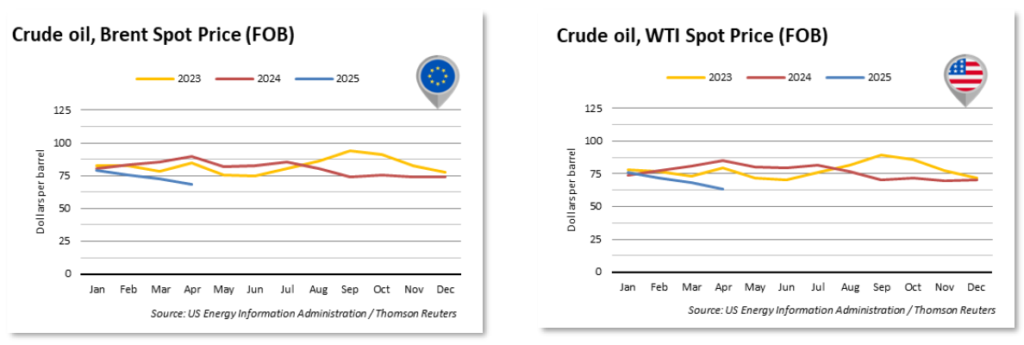

Energy

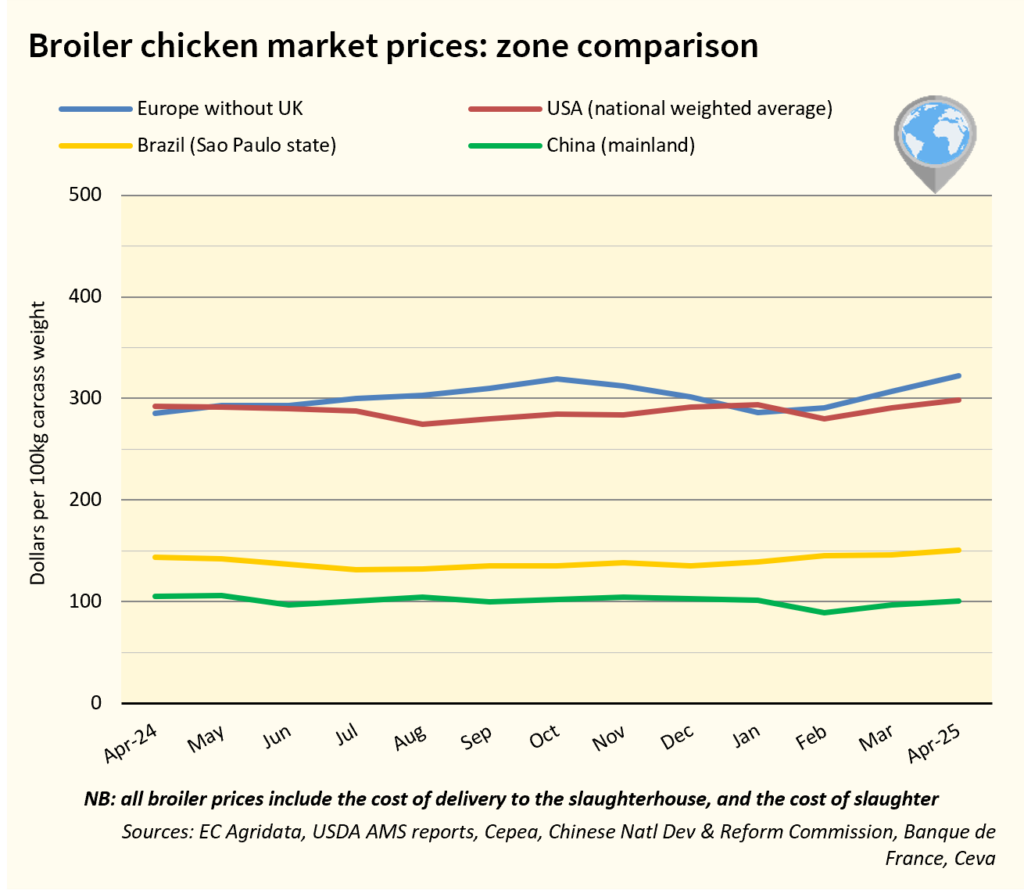

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

Global chicken prices are soaring as avian flu and US/China trade war disrupts supply chains. With major exporters like Brazil and the U.S. facing restrictions, markets worldwide are bracing for further price hikes and ongoing volatility in the poultry sector.

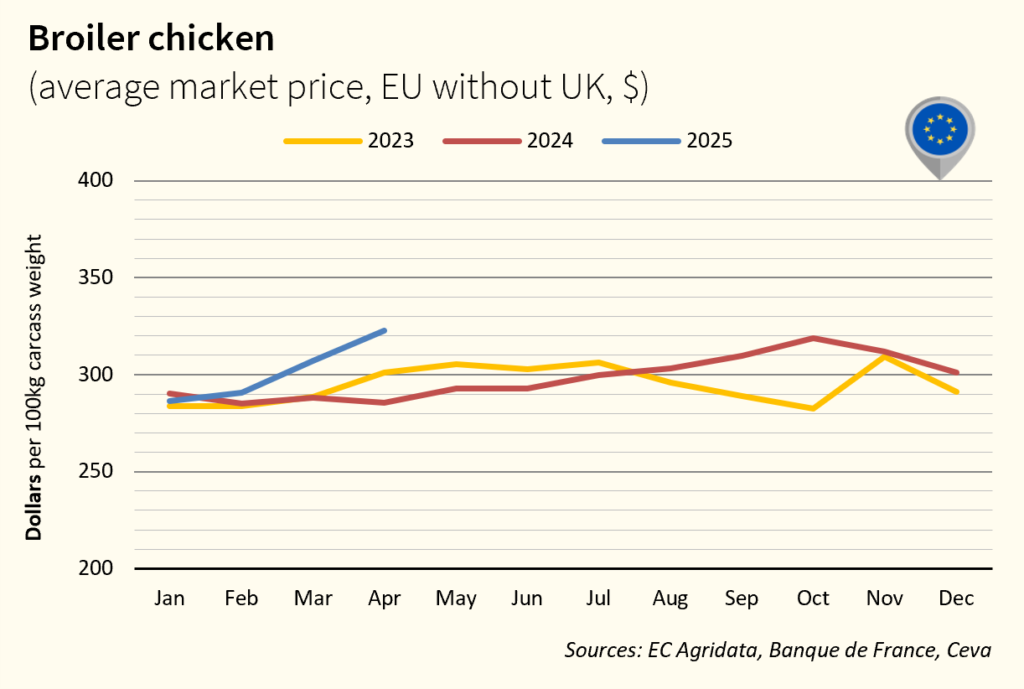

BROILER CHICKEN PRICE OVERVIEW – EUROPE

Chicken prices continued to rise, driven by persistent supply shortages and steadily growing demand in the context of ongoing HPAI outbreaks. The shortage of hatching eggs and day-old chicks remains critical. With tight domestic supply, EU poultry imports from Brazil surged by 41% in April. However, following the detection of HPAI in Brazil, the EU announced a full embargo on Brazilian poultry imports on May 19. In Europe, HPAI and strong demand have already pushed prices sharply upward since 2024. The Brazilian case is likely to drive prices even higher, supported by increased demand for EU-origin poultry.

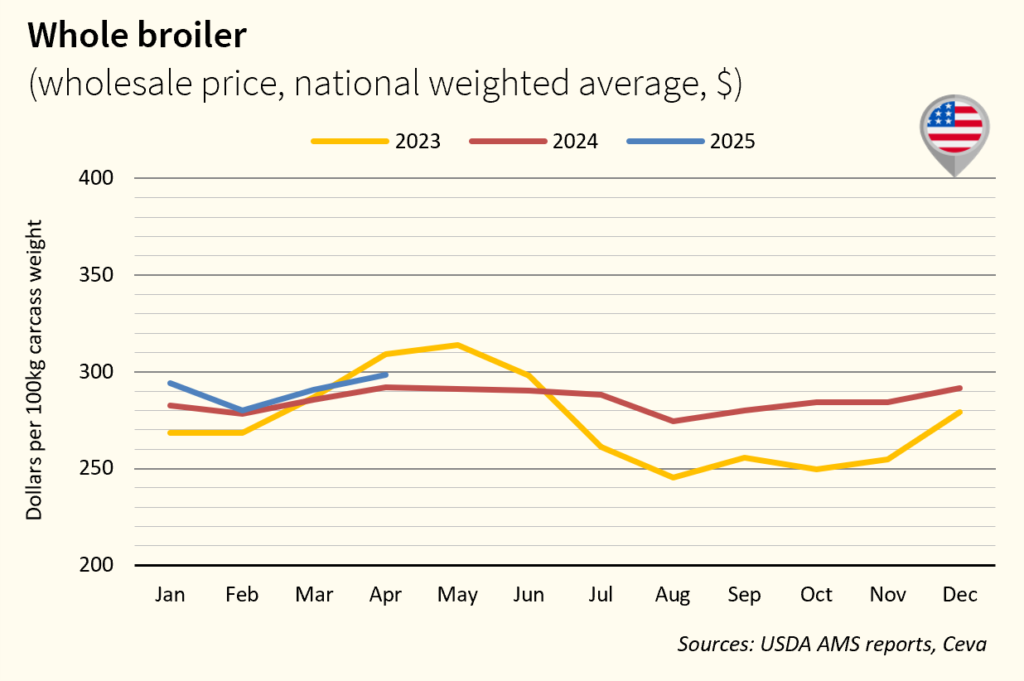

BROILER CHICKEN PRICE OVERVIEW – USA

In April, U.S. chicken prices rose by 2.7%, driven by strong demand and balanced production. While prices for most cuts remained relatively stable, boneless chicken breast saw a sharp increase due to particularly strong demand in this segment. U.S. chicken exports continued to decline in April, amid HPAI cases and ongoing trade tensions, particularly with China, which drastically reduced its imports from the U.S., down 83% to fewer than 1,500 tons in April.

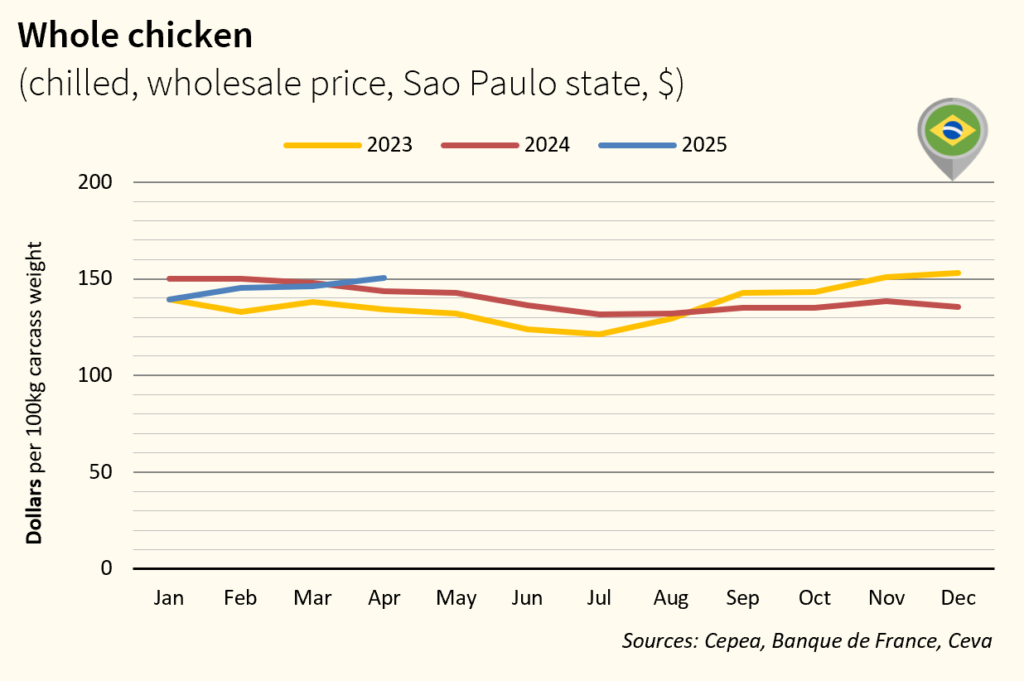

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

Chicken prices in Brazil rose by 3%, supported by strong domestic and export demand. However, the long-feared emergence of HPAI, detected for the first time in Brazil in a commercial poultry flock on May 16, sent shockwaves through the global poultry sector. Following the announcement, several countries imposed full or partial bans on Brazilian poultry.This development could significantly disrupt global supply chains, with up to 34% of Brazil’s poultry exports at risk. As a result, Brazilian export volumes are expected to decline. This may lead to a spike in international prices, while domestic prices in Brazil could soften due to reduced export opportunities.

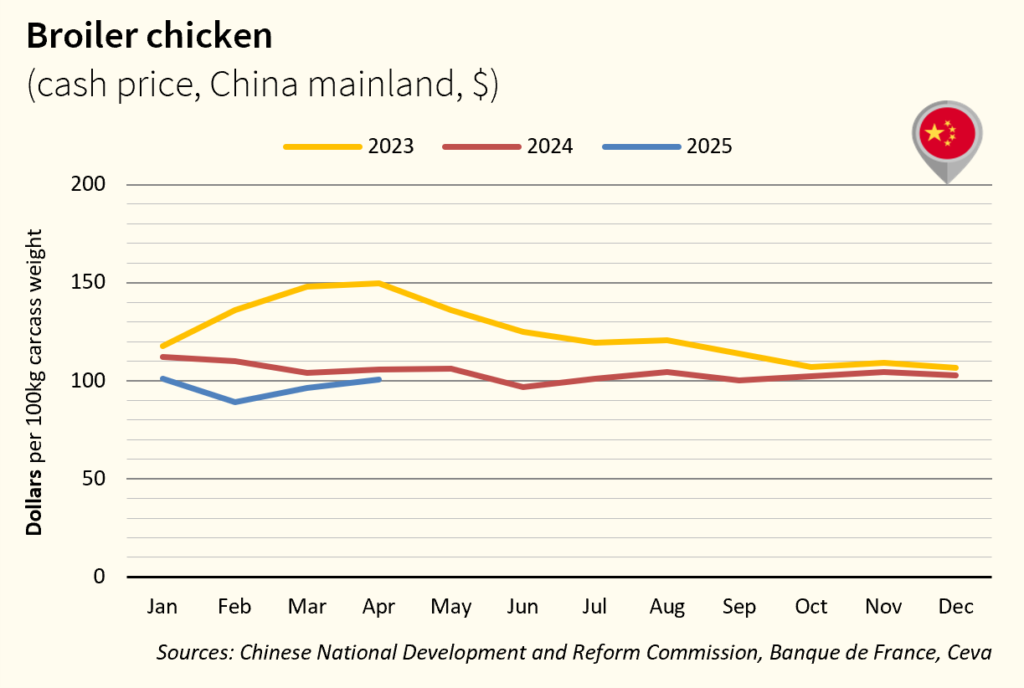

BROILER CHICKEN PRICE OVERVIEW – CHINA

In April, chicken prices in China continued to rise (+5%), driven by strong domestic demand and increasingly tight supply. The oversupply seen in previous months led processors to scale back production, while a drop in imports, due to limited global availability and tariffs imposed on U.S. poultry, further pushed prices upward. Moreover, following the HPAI outbreak case in Brazil in May, China implemented a 60-day import ban on Brazilian poultry. This move leaves China without its two main suppliers, the U.S. and Brazil. As a result, chicken prices in China are expected to continue rising in the coming weeks.

POULTRY

POULTRY