Poultry Market Outlook - September

Discover the latest insights with our Poultry Market Outlook this month!

Stay ahead of the curve with up-to-date information on global poultry protein market prices.

Dive into our expert analysis and discover the driving forces behind the industry’s evolution.

Stay informed, stay ahead—don’t miss out!

FARM INPUTS OVERVIEW – WORLDWIDE

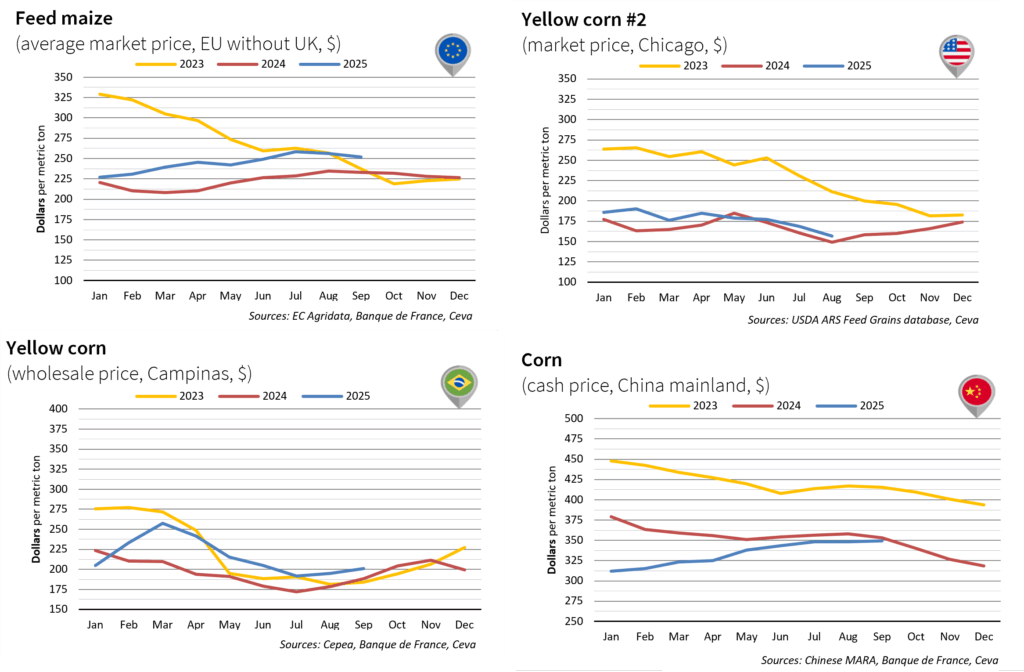

On the commodity markets, prices have followed different trends. For corn, prices are mainly driven by the results of the ongoing harvests. The global balance is expected to remain stable, with 1,287 Mt produced and record availability among the top four producers and exporters, particularly in the United States (427 Mt).

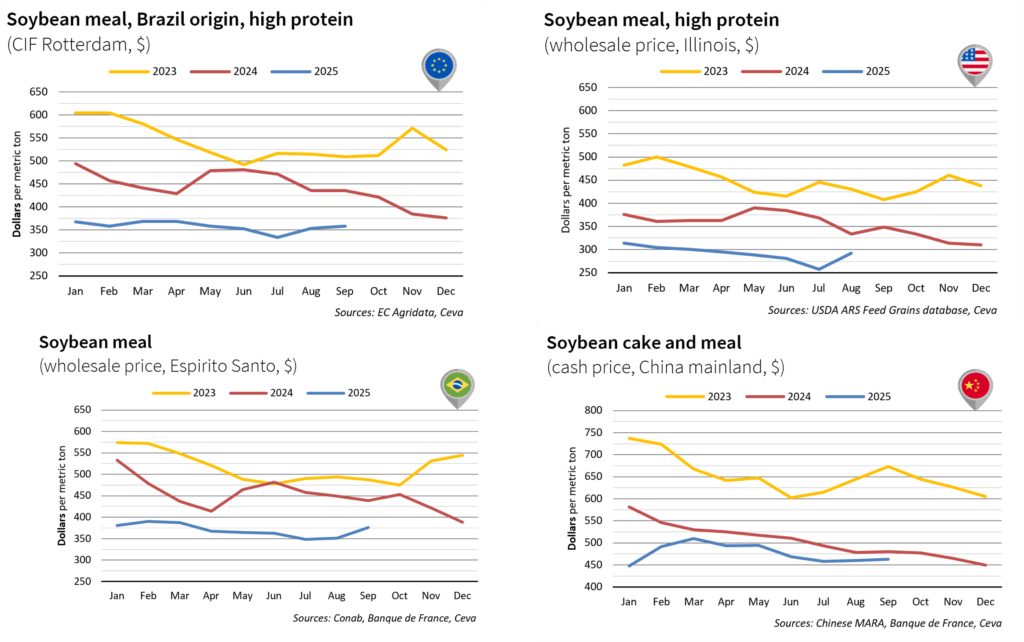

The soybean market remains highly dependent on ongoing trade negotiations. The situation between China and the United States is boosting Brazilian soybean shipments to China, which supports local prices and has ripple effects on other global markets.

Corn

- In the European market, corn prices fell again in September, down $4.2/t to $252.2/t. the start of harvesting eased the European market slightly, but production uncertainties persist.

- In China, corn remains broadly stable (+$1.0/t in a month) at $349.1/t. For the new season, output is expected at a record 295.0 Mt (+5.7% vs the five-year average). Domestic demand is nevertheless projected at 321.0 Mt. This gap will be covered by imports and stock drawdowns, which is supporting domestic prices.

- The strongest move was seen in Brazil, where the average price rose by $5.8/t in a month. Brazil is entering its peak export window. Results are solid so far, with 14.7 Mt shipped since August compared with 12.7 Mt in 2024.

Soya and Soybean meal

- In Brazil, soybean meal prices rose sharply over the month (+$24.4/t) to $376.1/t. This increase is mainly due to dynamic exports to China, even though shipments would usually start to tail off in the autumn.

- In the European market, soybean meal prices also moved higher in September, reaching $358.0/t. This mirrors the rise seen in Brazil, the EU’s principal supplier.

- Similarly in China, soybean meal gained $3.5/t in September. Beyond the Brazilian price rise, the Chinese market remains weighed by uncertainty over the future of trade relations with the United States, which is supporting prices.

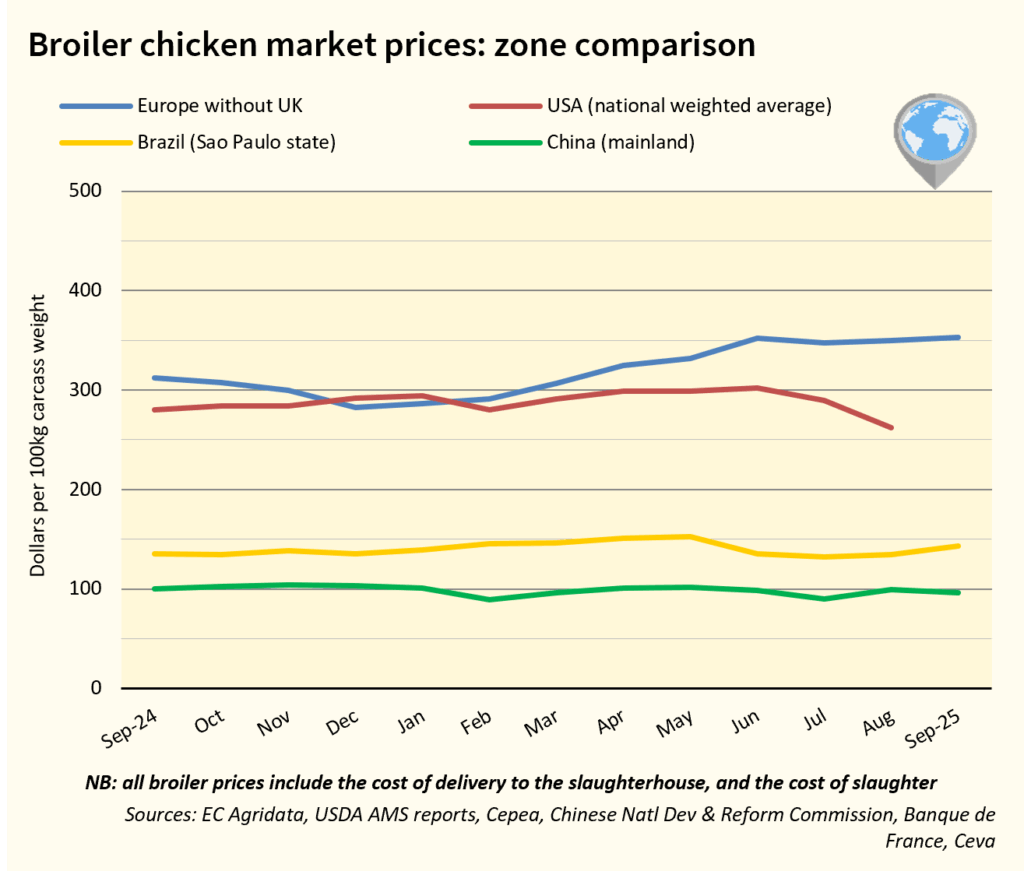

BROILER PRICE MARKET OVERVIEW – WORLDWIDE

In September, chicken prices continued to rise, and the overall market outlook remains positive. Strong consumption growth has fuelled international demand, driving prices upward. Compared with 2024, both production and trade volumes are expected to increase. However, concerns are mounting over the HPAI situation in Europe, with a growing number of outbreaks—particularly in Western Europe.

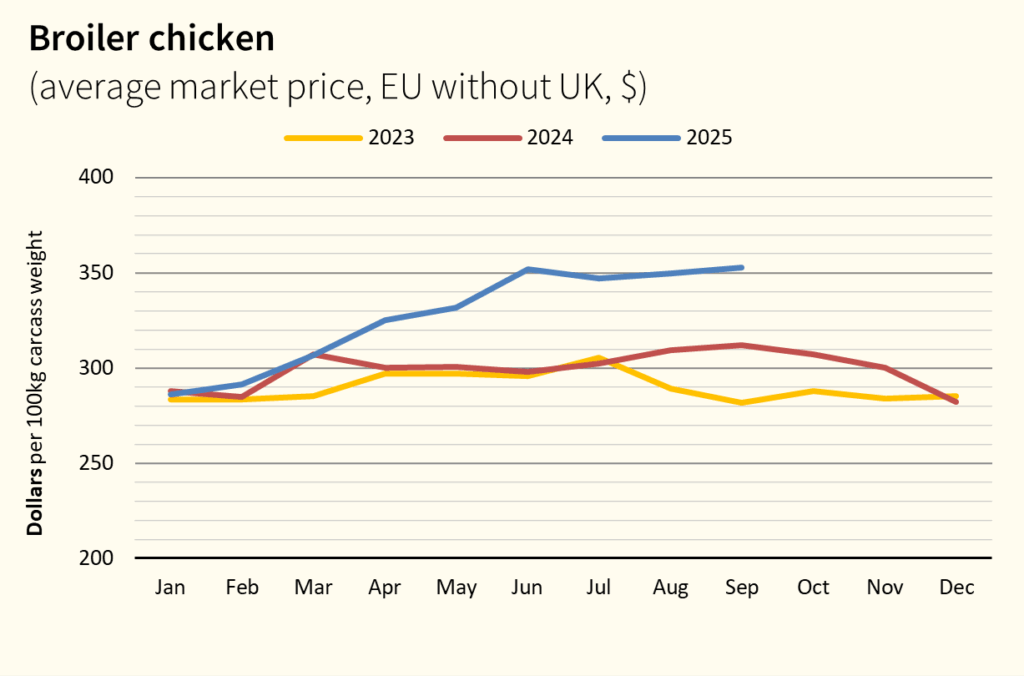

BROILER CHICKEN PRICE OVERVIEW – EUROPE

EU broiler prices rose again, supported by strong demand, restricted supply, the halt of Brazilian imports, and a reduction in imports from Ukraine.

This has tightened the market, redirecting demand towards EU-origin chicken. Production prospects for S2 remain positive, with a forecasted 3% increase. Since September 19, Brazil has regained access to the EU market, which should bring some relief. Nevertheless, the detection of HPAI cases in Spanish breeder flocks is expected to weigh on chick availability, slowing down the recovery.

BROILER CHICKEN PRICE OVERVIEW – USA

In September, U.S. chicken prices were expected to rise following a sharp decline during the summer. However, no recent data are available due to government shutdowns. The HPAI situation remains relatively calm. Production continues to grow at a positive pace, with output expected to increase by around 2% for the remainder of the year. Autumn demand should help support current price levels.

After several months of decline, U.S. chicken exports are now showing signs of stabilization.

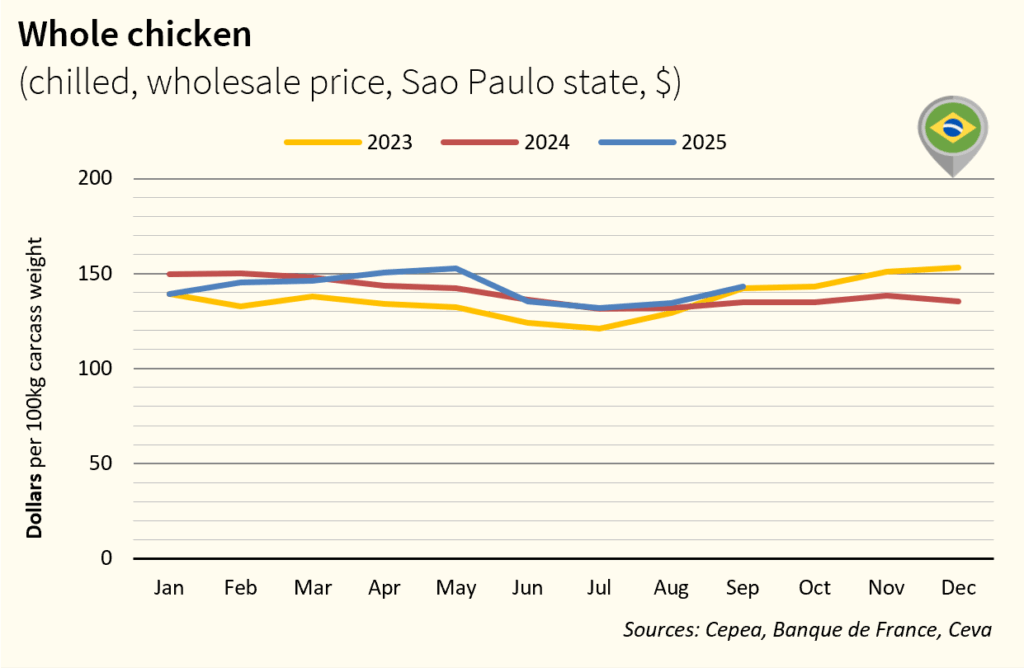

BROILER CHICKEN PRICE OVERVIEW – BRAZIL

In September, chicken prices increased by about 5% after three months of decline, following the HPAI case reported in May and the temporary closure of certain export markets. A gradual recovery in exports—particularly to the EU—has helped strengthen prices. Brazilian exports stabilized in September (+1%) after three months of contraction. However, the Chinese market remains closed to Brazilian poultry.

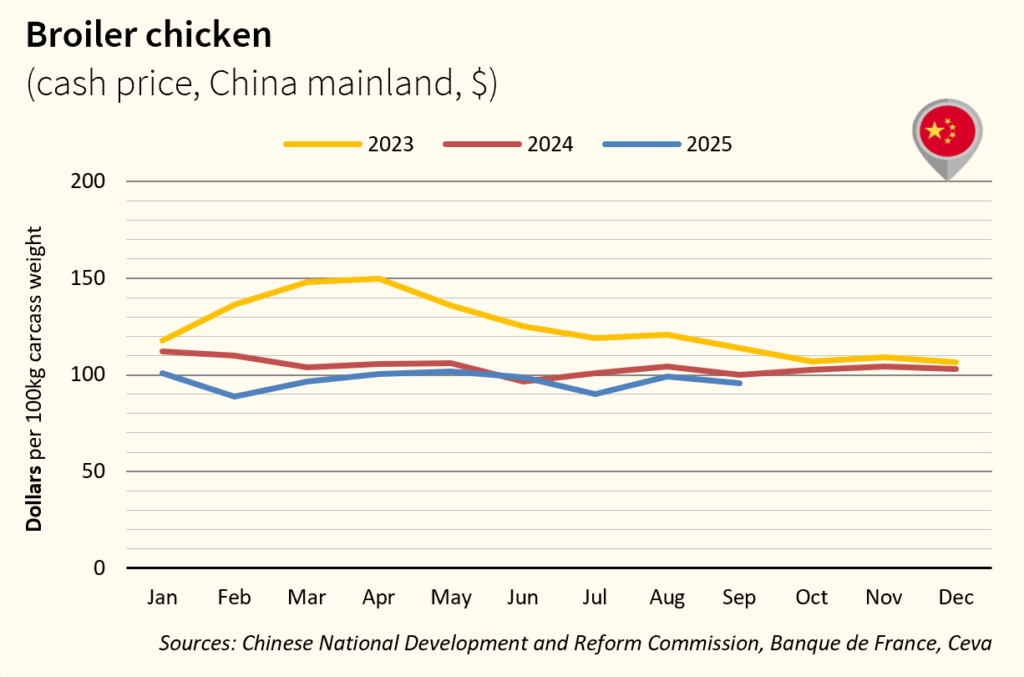

BROILER CHICKEN PRICE OVERVIEW – CHINA

In September, chicken prices in China fell slightly, mainly due to lower pork prices, weak consumer demand, and stock clearance by operators. Slaughterhouse activity remains limited. However, during the last week of September, white-feathered broiler prices rose in anticipation of the National Day holiday, when demand typically increases. In the short term, supply may tighten due to lower stock levels and reduced slaughter activity. China’s chicken imports fell sharply in September (-68%) as Brazilian shipments remained suspended for the fourth consecutive month.

POULTRY

POULTRY